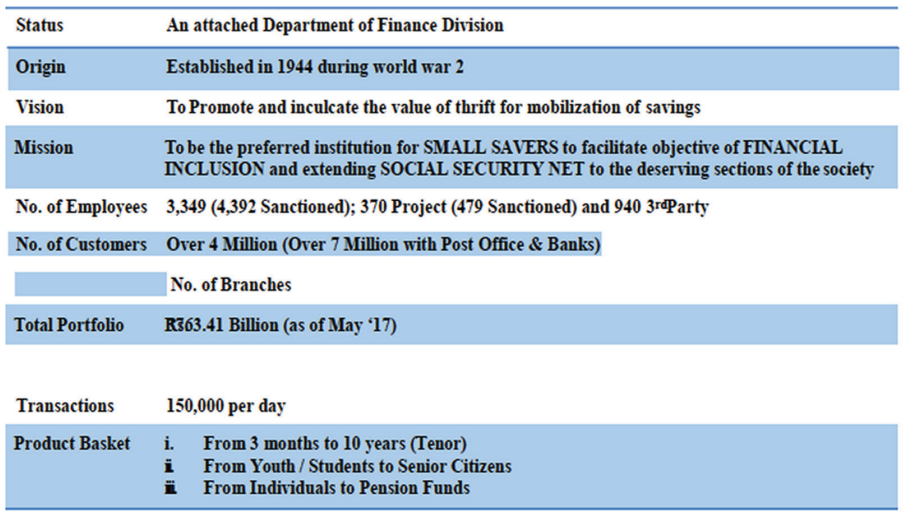

From profit rates to automation, from customer profile to product offering, from customer service to organizational structure, etc. etc. National Savings has always been part of discussions and debates in drawing rooms and on streets. This is not a surprise given that National Savings touch the lives of almost 1/4th of each Pakistani directly or indirectly. While some of the criticism on this organization is genuine as there’s huge room for improvement and reforms; however, in most of the cases, this censure has been undue and based on the lack of understanding or exposure with the organization. In order to address this misunderstanding, this write-up has been prompted which will share some facts about National Savings.

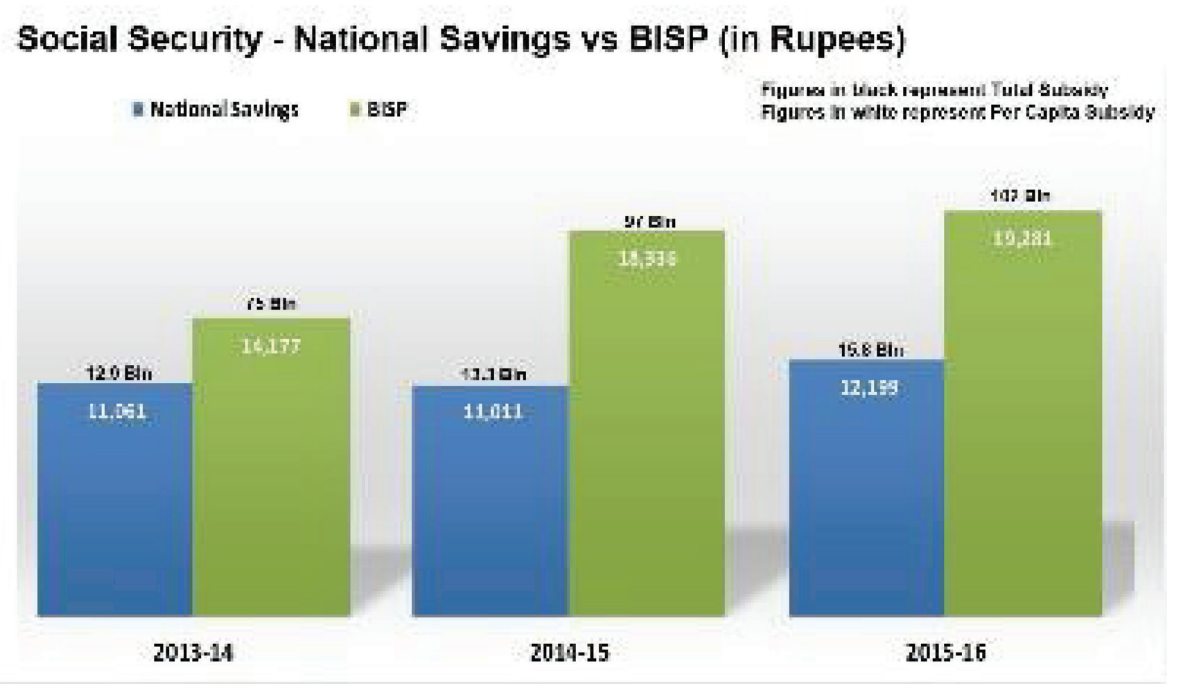

Over a period of time, particularly in the last decade, National Savings transformed itself from a retail debt raising arm and the source of infrastructure funding of the Government into a formidable vehicle for Financial Inclusion and a provider of Social Security to the vulnerable sections of the society. This is very interesting to see and analyze that in the product mix of National Savings, 1/3rd of the total product mix comes from the social welfare schemes which were launched in 2003 only. The yearly growth in these schemes having been consistent.

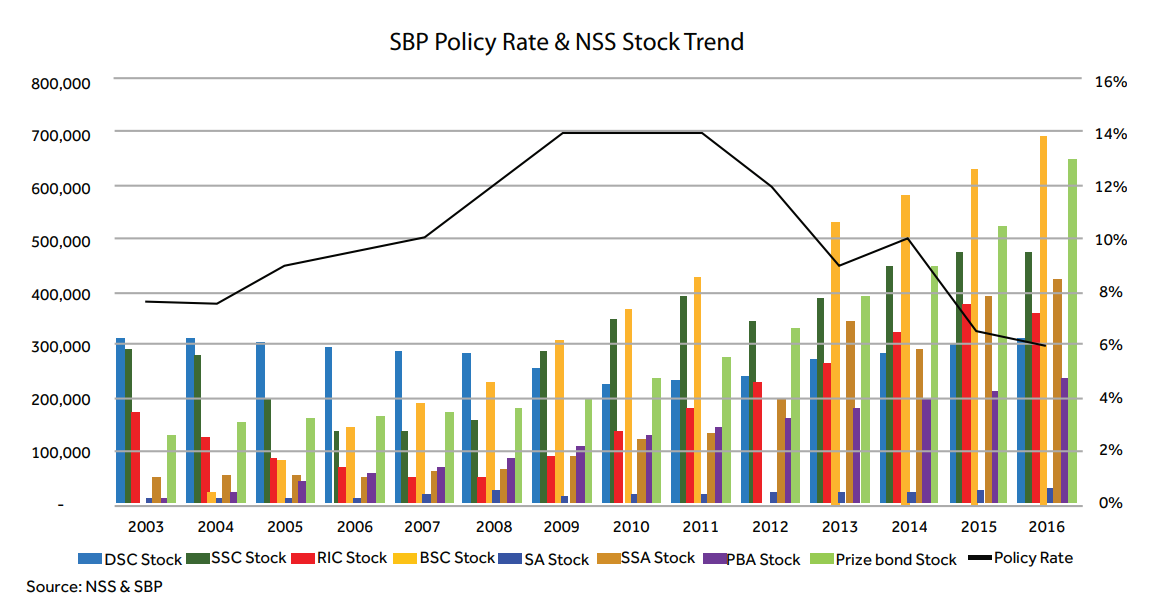

National Savings products have traditionally been profit rate sensitive, recent research done by Standard Chartered (“The Race to Save”), suggest that almost 30% of the investors make the decisions based on interest rates and hence there has been an erratic trend in the product mix as can be seen from the graph herein. This trend is; however, changing and the bigger idea is to achieve inelasticity of National Savings Schemes (“NSS”) demand with profit rates.

The strength of the product bouquet of National Savings is such that it provides an inherent balancing act – when the demand for one product is down, the other becomes more attractive – e.g., in the low interest rate environment, traditional products of National Savings take a beating; whilst demand for prize bonds move up as the appetite of the investors to take a chance on the prizes, and to forego the fixed return on their investments, goes up.

The social welfare products of National Savings remain largely insensitive to the interest rates. The fact is that there’s a very large number of investors of National Savings who lives off, and meet their ends through the monthly return on their investments in these social welfare schemes. Government is aware of this situation of the investors of National Savings and ensure that the rates remain at the levels which allay these concerns. The greater idea is that NSS provide the investor a decent/ valuable amount of profit every month to live in the society with respect and dignity. Almost 50% of the total profit that National Savings pay-out every year goes for these welfare schemes which shows Government’s unwavered commitment towards the deserving sections of the society.

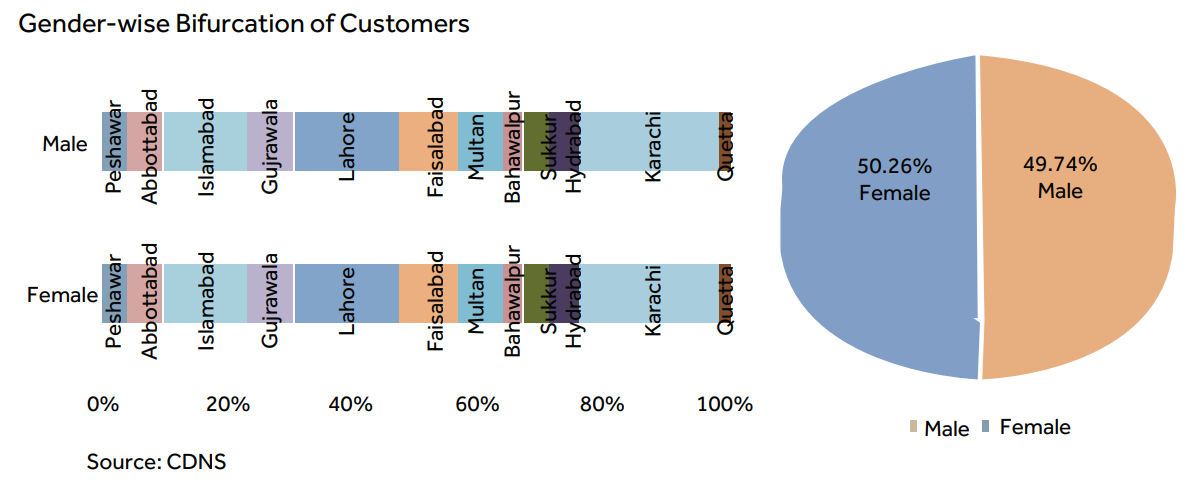

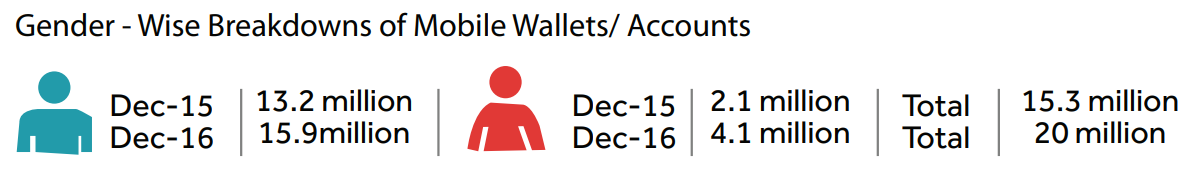

National Savings remain the most effective and formidable vehicle to support financial inclusion, particularly women. More than 50% of the investors of National Savings are women vs merely less than 4% in the banking sector and average 25% in South Asia – a testament of true financial inclusion and women empowerment. This is evident from the State Bank data that the technology plays a vital role in women financial inclusion. The number of women mobile accounts as the percentage of total mobile accounts have increased from 14% to 21% in 2015-16, keeping this statistic in mind and the fact that over half of the savers base of national savings are women, special emphasis is being put on offering of mobile wallet/ accounts through system upgradation and rolling out alternate delivery channels on the top most priority basis.

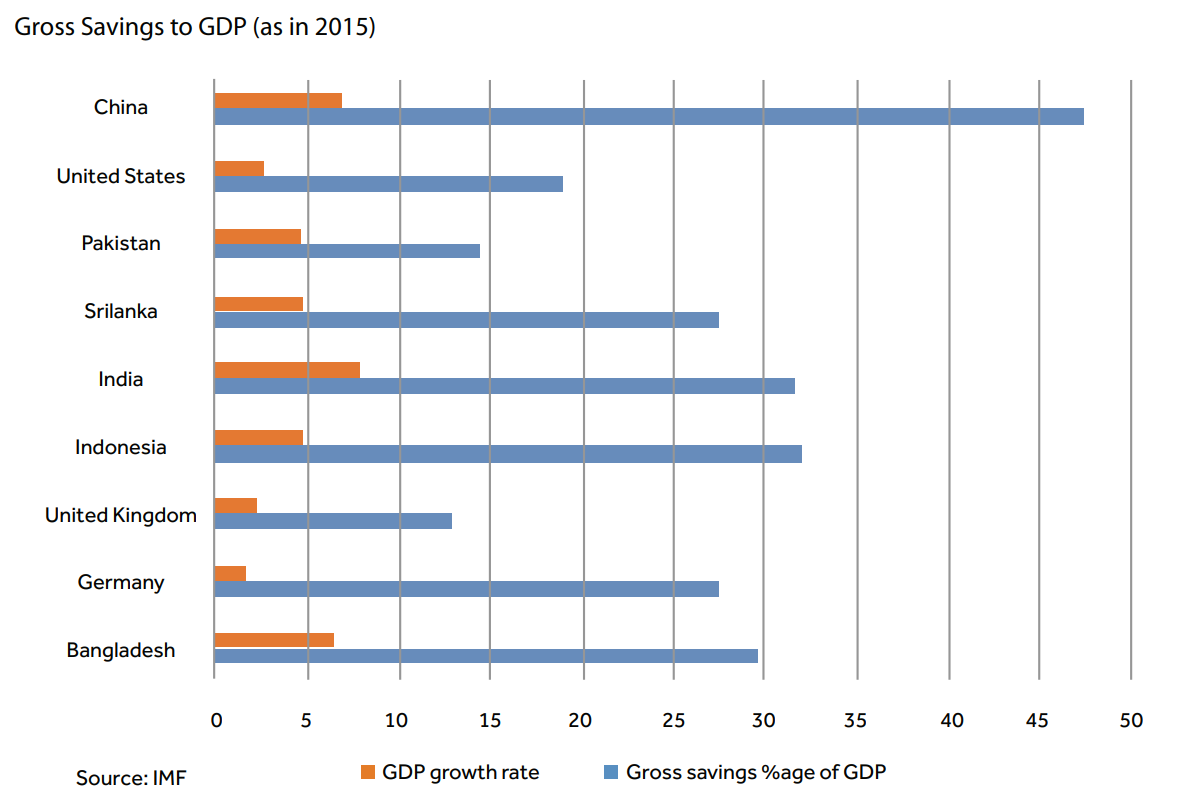

Pakistan has one of the lowest saving rates in the region which has direct relationship with the economic growth rates. Whilst National Savings, as an institution, contributes less than 1% towards the GDP and around 10% in the Domestic Savings to GDP Ratio of 7.5%; however, there’s substantial room for improvement on these ratios over a period of time and perhaps this important Government vehicle shall take a leaf on this.

Realizing the emerging importance of National Savings, the Government has initiated the process of restructuring of this very important but highly misunderstood organization with the resurrection of the corporatization which was initiated and has been pending for over a decade. The customer service remains at the heart of the reform agenda. All the initiatives taken are with the objective to provide the best in class service to the customers. Given the nature of business and products offered, customers of National Savings are much more demanding than usual banking customers; therefore, customer service, in case of National Savings, becomes even more critical than otherwise in-service industry.

Effective communication is the most powerful way to addressing, proactively and retroactively, the concerns of both external (customers) and internal (employees). Listening to the customers can only help in improving public delivery. Therefore, opening-up of more channels of communication with the savers. Customer service and complaint resolution mechanism of National Savings have significantly been improved along with revamping of its existing website (www.savings.gov.pk) which is made much more user-friendly and topical, activating social media (FaceBook, Twitter, Instagram, WhatsApp), rolling out of SMS service to the clients and employees, and establishment of a dedicated Complaint Resolution Cell in the Director General’s Office.

The first and the foremost element of reforms was to improve controls and put the right HR structure in-place. Its existing centralized organizational hierarchy has been restructured by bringing it on modern corporate lines, while empowering field offices by delegating powers in newly established Zonal offices which were formed based on cluster of three regions each. Transparent posting and promotion policies have also been laid down and implemented. Audit and Accounts have been separated for ensuring transparency in the financial matters. Special focus has also been given to training and capacity building of the staff. Internal communication amongst organization’s employees has also been enhanced by launching a quarterly newsletter and introducing specific online communication groups which have immensely reduced the time consumption for initiation and execution of decisions.

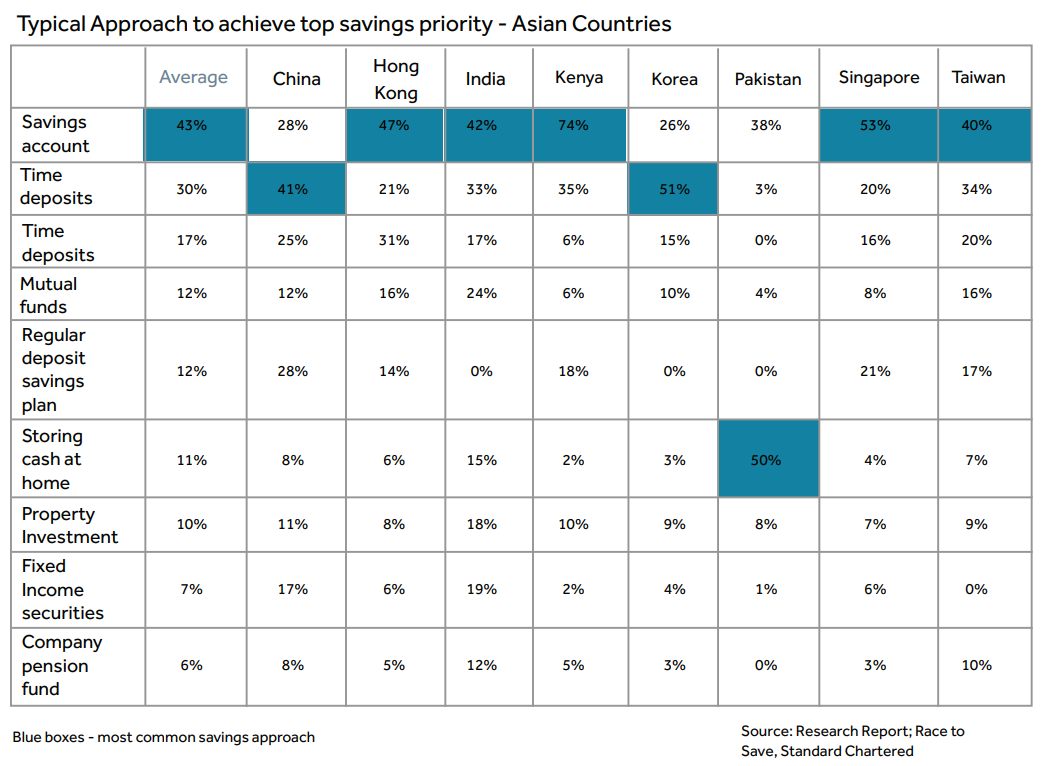

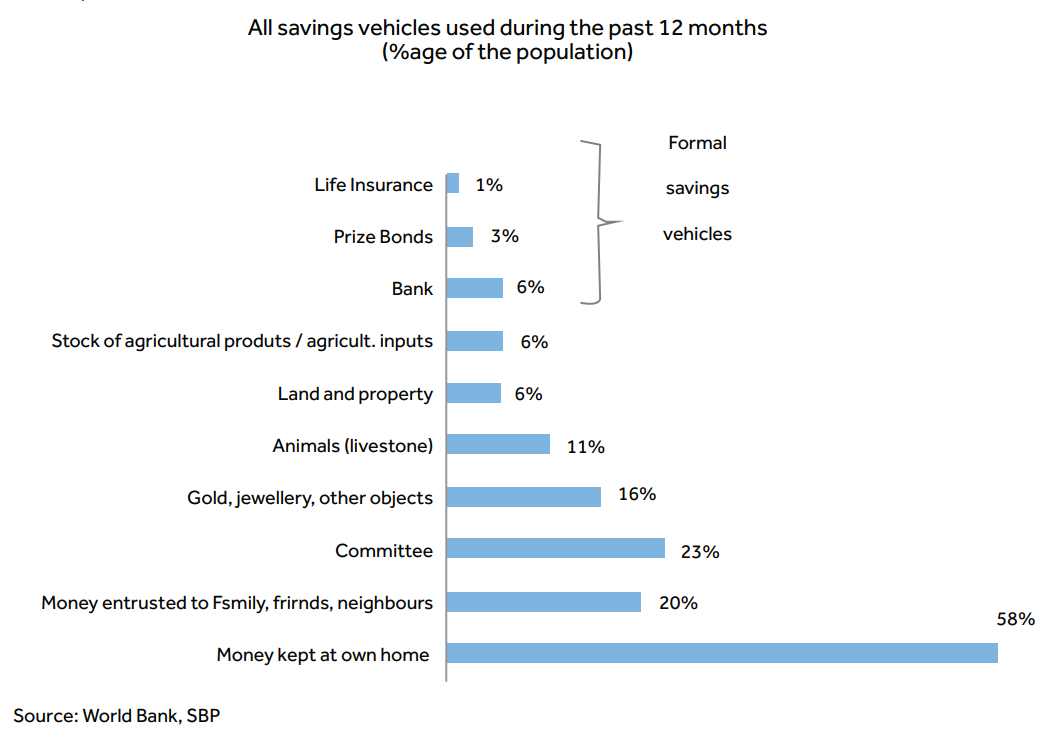

The data of cash storage at home in Pakistan is startling as shown in the table; “Typical approach to achieve top savings priority in Asia”. Therefore, one of the key objectives of National Savings is dematteressing the cash. During 2016-17, National Savings has taken numerous strategic initiatives for strengthening of the National Savings Schemes. After a gap of over 7 years, National Savings successfully launched a new product in March this year – first of its kind Rs. 40,000 Premium Prize Bond (Registered), which is issued only to investors in their own names and has the unique features of both profits paid biannually and attractive prize money through quarterly draws. Both the profits and the prize money are directly credited into investors’ bank accounts which has also been offered for the first-time. This product is a major step in achieving the much-needed documentation of the economy – a very bold and proud initiative on the part of the Government. Despite distribution constrains (sale only through SBP offices currently) and stringent documentation requirements, the response on the product is very encouraging. The Finance Minister has directed National Savings to digitize the existing Rs. 40,000 registered prize bonds and include other bonds of smaller and larger denominations in the registered category within the next Fiscal Year. The distribution channels for these registered prize bonds are being enhanced.

Another historic initiative – National Savings became the only non-banking member of National Institutional Facilitation Technologies (Pvt.) Limited (known as NIFT) – the Banking Clearinghouse. With this initiative, the profits of National Savings investors can be collected into their respective bank accounts; thereby, offering safety and security and access to ATMs, Internet & Mobile Banking of their respective banks. The overall improvement in time for the collection of profits by the senior citizens through cheques has been achieved from 5/10 days to 1/3 days. To further the agenda of Financial Inclusion, this is absolutely critical to get the cost of customer acquisition to be rationalized. This can only be achieved through introduction and usage of technology. The process of automation has been underway for some time now and needs to be further improved and upgraded for customer convenience and to promote financial inclusion. On the automation side, the organization is going to complete data crunching and decentralized digitization of more than 222 (Out of 376) National Savings Centers (“NSCs”) across Pakistan by September, 2017; thereafter, the third and the final phase of digitization will be initiated to complete 100% digitization of NSCs across the Country by December 2019.

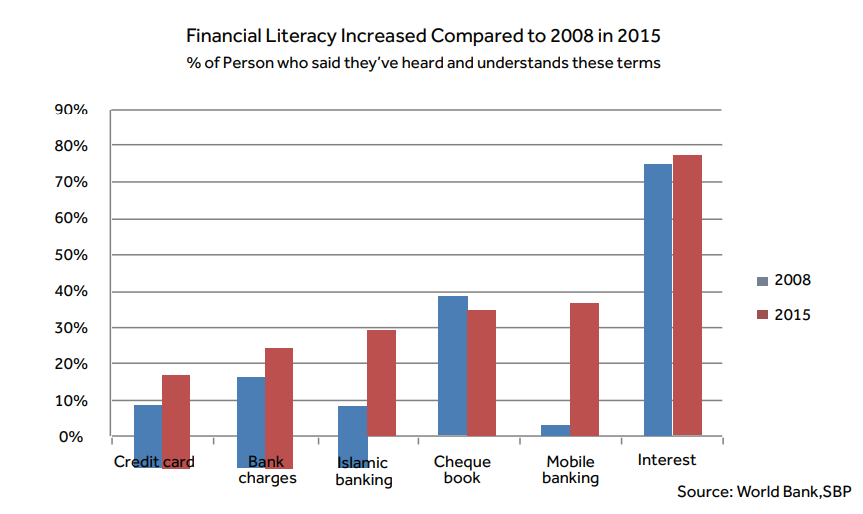

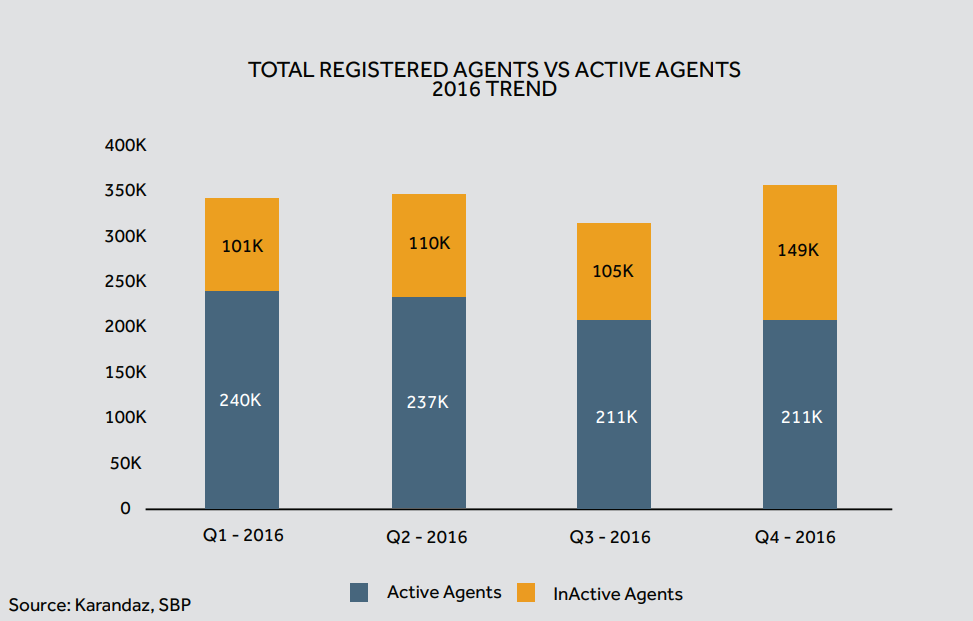

The supply-side – access points, marketing/ investor education and products – other than taxation and cultural aspects, are the main constrains for the subdued saving rates in Pakistan. On the distribution front, other than automating our IT systems, we’re exploring possibilities of appointing non-financial sector agents to get to the door-steps of the existing and the potential customers. National Savings has rolled out a major IT infrastructure revamping initiative which is being assisted by World Bank and Karandaaz. Under this initiative, a Centralized IT System with modern ERP system will be put in place to achieve double entry/ accrual-based accounting system, a Data Centre/ Warehouse and Disaster Recovery Centre will be established, along with the introduction of Business Intelligence framework. National Savings is also coming up with numerous Alternate Delivery Channels, like access of accounts by the investors through cellphone & internet, and introduction of debit cards for direct access to the ATM/POS network, and the 211k active agents of mobile banking, etc.,which will act as cornerstone for achieving Financial Inclusion targets. The first region out of the total of 12 regions will cutover by December 2017 with all the regions to be connected on-line by December 2018. National Savings is actively exploring the option of introducing the concept of virtual branches with scripless investment products/ schemes.

With enhanced distribution network of National Savings, there will be an opportunity to sell other products like Health and life (3rd Party) Insurance Policies, tying up with international remittance companies like western union and others to deliver the remittance to their customers and collection of utility bills etc. are also on the cards to be offered as part of the package with the various schemes of National Savings. The eventual idea is to convert the NSCs into Community Centers, given the customer profile of National Savings and the way NSCs are currently been used by the investors.

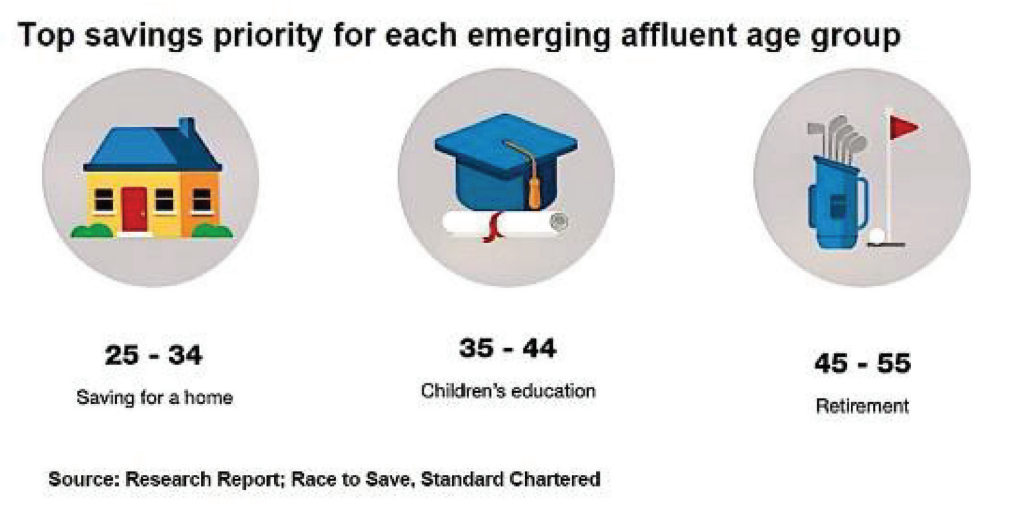

The narrative to create new meaning to the products/ schemes of National Savings is critical; for example, prize bonds could be used as gifts on various ceremonies/ events; Defense Saving Certificates as investment for kids’ education, wedding; Behbood as a gift for aged/ retired parents, etc. The campaign on these lines has already been launched and has been taken very well by the market. For inculcating Savings Culture among the masses, World Savings Day 2016 was celebrated for the first time in the organization’s history and the video message of the Director General on the initiative taken by National Savings to promote financial inclusion and restructuring of the organization was aired at the International World Savings Day conference in Jakarta. As for the future plans of product offering during 2017-18, keeping in view the customer profile, National Savings is coming up with innovative products in order to increase financial inclusion of small savers and unbanked population and to contribute towards the Social Safety net of deserving segments of the society. With respect to this, Finance Minister has announced the extension of the Bahbood Savings Certificates to the Disabled Persons and the launch of Shuhadas’ Family Welfare Accounts for family members of the martyrs, in the recent budget speech. Overseas Pakistanis

Certificates / Bond, an exclusive scheme for non-resident Pakistanis, are under active consideration. Shariah products are taking firm roots in Pakistani society and National Savings is cognizant of the fact and working on the possibility of launching a much demanded Shariah Compliant Savings Certificates. To ensure sustainability of the above reforms, this is realised at the highest level in the Government that it’s imperative that National Savings be given autonomy and converted into a corporation. The process of corporatization is well underway as mentioned earlier.

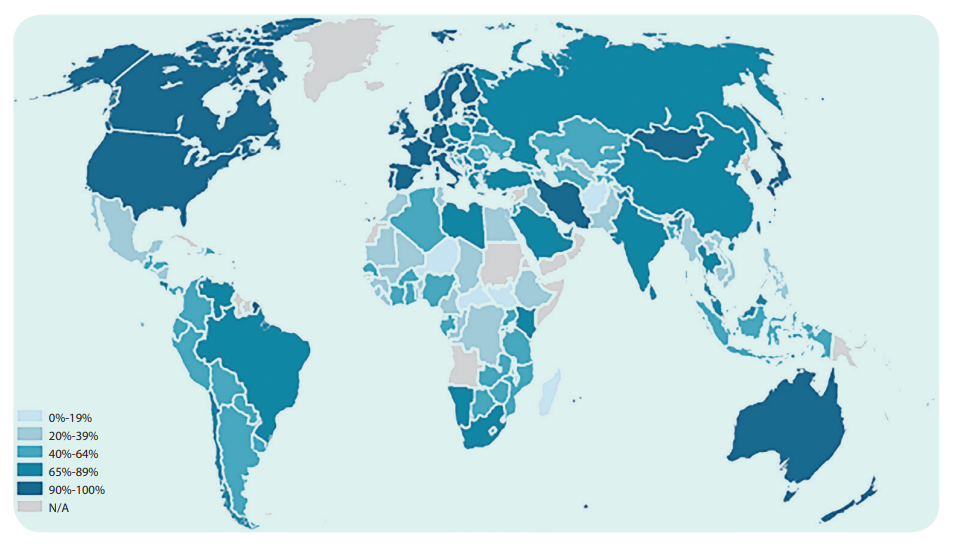

Having said that the role of local banking industry, mutual funds and stock market players in promoting savings culture in Pakistan remains the most important element, particularly given the footprint and the presence of these institutions and their contribution into the Country’s GDP. The account penetration of Pakistan is too low at 16% as oppose to its peers. This poses a significant opportunity for the financial sector in Pakistan as over whelming number of potential account holders are up for grabs. This may require some policy changes which should be initiated by the financial sector through their respective for a and regulators.

The good news is that “the cat is in the bag” for this most misunderstood organization – National Savings; however, the financial sector and capital market players still have to put their act together to meet the larger national objective of promoting savings.