This is the first article of the three part series on Managing External Account. The second one will be “Managing External Account – Fiscal Policy” and the third and the last one being “Managing External Account – Structural Changes”.

The Monetary Policy is the key to influence trade/ current account of any country. The extent and the effectiveness of that, however, varies from country to country, given country’s own political and economic dynamics and other realities on the ground. These elements must not be used as “one-size, fit-all” as part of the template to manage the economy, particularly the external account. The effectiveness of monetary policy is already under debate these days, particularly in Europe, due to substantial accumulation of price insensitive global sovereign debt over decades, making monetary policy tools less potent.

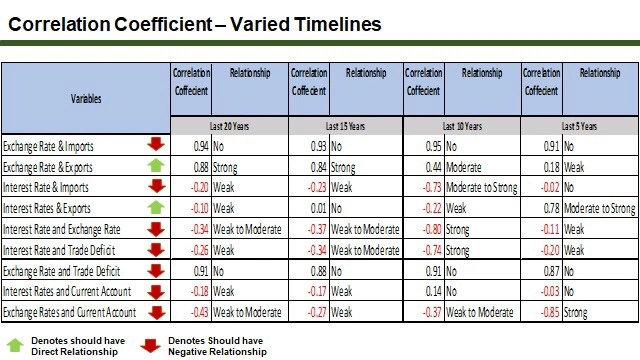

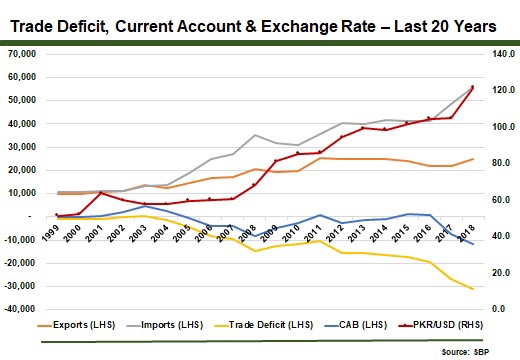

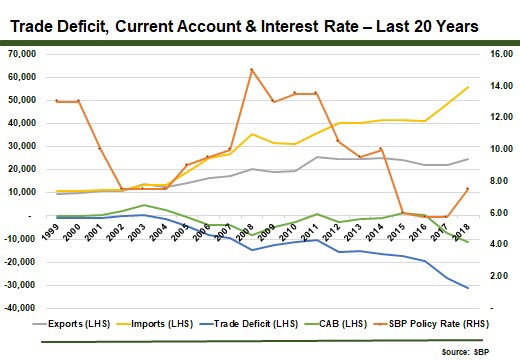

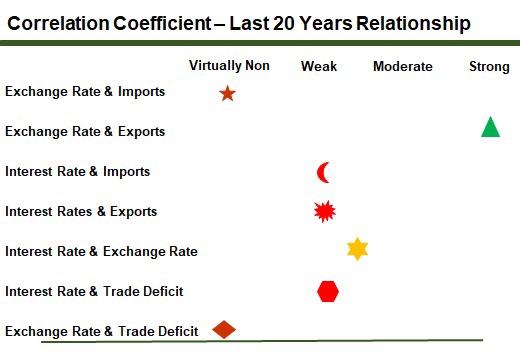

To evaluate the impact of these instruments on Pakistan, we have tried to plot the trade data for the last 20-years (since 1999) and compared it with interest rates and exchange rates during this period to figure-out the correlation between these elements. The result of this exercise will help the policy-makers to appreciate which instrument to play when and to what extent to achieve the objective of managing trade and current account. For the purpose, correlation coefficient amongst various variables was calculated.

The outcome of this drill has been absolutely fascinating as it has predominantly been off the conventional economic principles in a perfect environment or in more developed economies. Furthermore, the change in the relationship of various factors under assessment over different timeframes have also been very interesting, particularly the last 10-year period which has been a true outlier, probably due to political reasons. However, the most authentic of the chronologies seem to be the two decades one, as it has appropriately covered different sorts of events in different time periods. Hence, the requirement for necessary shift in the thinking and the strategy of policy-makers to manage the much-needed present current account deficit at hand.

At the outset, one must highlight that neither interest rates only or exchange rate in isolation nor they both put together can address the acute challenge of the prevailing current account deficit. A very large grey-economy and the substantial funding needs of the Government being met from the market (and becoming a dominant borrower), renders monetary policy actions compromised and help in managing the situation to an extent only. There’s an obvious need for strong support of supplementary measures on the fiscal front to stretch the shelf-life of monetary policy tools and finally need the most difficult structural changes to address the issues on a sustainable basis. All these factors, monetary policy, fiscal policy and structural adjustments must move in tandem (or at least in a strategic, synchronised fashion) to get the full benefit of these available instruments; any of them run independently will have compromised results. Most importantly, the degree of difficult decisions escalate from the first phase of using monetary policy elements to the eventual implementation of structural reforms. Thus, high-level resolution / commitment on the part of the political actors / Government becoming a prerequisite to take the maximum advantage of these available constituencies to manage the economy, particularly the external account in the short to medium run.

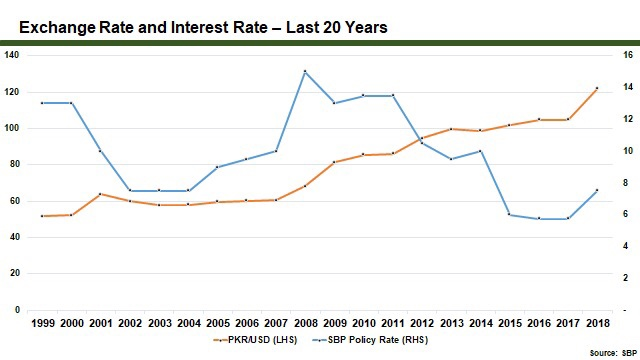

Let’s first look at the relationship strength between interest rate and currency in the context of Pakistan. The convention says that the relationship between these two factors shall be strong and inversely related – ie., interest rates go up, currency stabilizes or move inversely, and vice versa. However, in the context of Pakistan economy, the direct relationship between the two has been weak to moderate, which means that to play with interest rate to manage the currency is at best moderate but it could be safely assumed as weak looking at the relationship between the other elements of current account. While jostling with the decision on the interest rate adjustment with the perspective of managing the current account deficit, the policy-makers must keep this fact in mind. The elasticity between interest rate and trade / current account deficit is weak; in fact, the relationship with import and export individually have also been weak. Therefore, this can be safely assumed that interest rate adjustments has minimal impact on swaying the current account deficit. Having said that, this must also be kept in mind, however, that the movement of policy rate remains a strong indicator and message for the market on where the policy-makers see the economy going, but using it as a tool to manage the trade / current account deficit remains feeble.

Now, let’s turn to the influence of exchange rate to manage the trade deficit. Whilst the relationship between exchange rate and exports is “strong”. However, given the fact that we have wide trade deficit and there clearly seems to be “no relationship” between the exchange rate and the imports; therefore, there’s hardly any effect of exchange rate to manage the overall trade deficit. There’s weak to moderate correlation between the exchange rate and the current account deficit due to very large number of remittances which could be impacted with the change in currency conversion rates. Given the fact, however, that our remittances are largely consumption-driven, the flow of the currency will remain indifferent to the exchange rates, as such. Therefore, our conclusion remained more focused on trade deficit rather than current account, in this case. The point here’s that we must use the currency adjustment with extreme care, given it’s influence on managing our trade deficit. It seems that with stubborn imports (essential items, high-end consumer products, etc.) and narrow, low value-added exports, at times the exchange rate movement does more harm than help. However, like interest rates, currency adjustment remains a strong messaging instrument for the market on the state of the economy.

To conclude, the 20-year data proves that the exchange rate has “virtually no impact” and the interest rate has “at best a weak influence” to manage the trade and the current account deficit in Pakistan. Therefore, the decision-makers shall make a decision to adjust these two key monetary policy tools with extreme caution to manage the pace of the economy and the management of FX reserves through trade. This is also resolved that in orders to manage the imports, the best instrument available is the fiscal policy (duties, cash margins, bans all together, etc.) at this stage, while simultaneously working on the import substitution, a medium to a long term fix. On the other hand, the sustainable growth in exportable flows could only be achieved through a medium to long term solutions with structural changes (value-addition, non-conventional exports, etc.) and exploring new paths, like manpower exports – an area gravely neglected – which must be given the status of an industry and measures must be taken and offer incentives, accordingly. We’re sort of left with medium to long term solutions, other than the aggressive fiscal measures, while all other actions, particularly the monetary policy ones, are a temporary respite and may act as a ventilator for the economy and may not be beneficial in the long haul.

Previous

Next