Mr. Zafar Masud and the senior management of The Bank of Punjab recently engaged in a dynamic one-day training session on the ESG Leadership Program by Pakistan Institute of Corporate Governance (PICG).

The program focused on environmental, social and governance aspects, equips our leaders with the knowledge and tools essential for steering the banking sector towards a more sustainable and resilient future.

Source: BOP Facebook

A few Words from a Guest Speaker of ESG Leadership Program

One of the guest speakers at the ESG Leadership Program Maleeha Mimi Bangash says in her post on LinkedIn, that feels delighted and privileged to be a guest speaker for Environment Social, Governance (ESG) in banking at the The Bank of Punjab for the Steering Committee.

She express that the session with the top leadership of BOP was excellent, dynamic and interactive and that it was wonderful to have the presence and participation of all the group heads and senior management.

She further added that the ESG commitment starts at the very top, and emanates from the vision at the senior leadership and board level. ESG is aligned to the strategy and embedded in all the work of the Bank.

ESG for banks is a journey and not an event, says Maleeha. The fact that BOP has already started the journey is heartening, she ads.

ESG Leadership program is a great opportunity for a progressive bank like BOP which can tackle the challenges, and meet the broad based consumer demand. BOP team has the passion and conviction to get poised to be a successful ESG bank working for the purpose of banking for a better world by ensuring a sustainable and healthier environment, and a future which is more responsible, equitable and inclusive.

She concluded by saying that there’s no better gift to give to our future generations and thanked Nadira Saeed & Memosh Khawaja, GCB.D, CCB.D and Pakistan Institute of Corporate Governance (PICG).

She extends her appreciation for the impressive leadership at the BOP including but not limited to Mr. Zafar Masud, Arslan Muhammad Iqbal, Farid Khan, Asif Riaz, Nofel Daud, Nadeem Amir, Khawar Shahid Ansari, Faisal Ejaz Khan, Ahmed Mansoor, Hamza Randhawa, Imran Ashraf, Syed Muhammad Rehan, Umer Iqbal Sheikh and Alia Zafar

From Banking Titans to Social Impact Crusader — Who is The Zafar Masud

Zafar Masud isn’t just a name, it’s a tapestry woven with threads of business acumen, unwavering resilience, and a deep commitment to improving lives. As the CEO of Bank of Punjab, Pakistan’s financial behemoth, Masud navigates the complex world of finance with the dexterity of a seasoned captain. But his impact extends far beyond balance sheets and market caps.

At the helm of Bank of Punjab, Masud’s vision and leadership have propelled the institution to new heights. He’s not just a CEO, he’s a builder. Prior to assuming this mantle, his extensive experience in multinational banks honed his financial prowess, a skillset he later deployed at the Ministry of Finance, playing a pivotal role in digitizing National Savings, paving the way for greater efficiency and inclusion.

See also: Dr. Amjad Saqib Presents Akhuwat Souvenir to Mr. Zafar Masud

Masud’s heart beats not just for financial results, but for social impact. He helmed the crucial Task Force on framing the SOE Law, contributing to shaping the governance of state-owned enterprises in Pakistan. His focus on development shines through in his role as Chairman of OGDCL, Pakistan’s energy lifeline, where he ensures that the nation’s thirst for power is quenched.

Masud’s entrepreneurial spirit shines through in his ventures beyond boardrooms. The Zafar Masud Foundation, a testament to his unwavering commitment to passenger safety, was born from the ashes of his own harrowing plane crash experience. Through this initiative, he advocates for awareness and improved survival strategies, ensuring fewer families face the tragedy he knows all too well.

Masud’s story is not just about professional triumphs, it’s a saga of defying the odds. As one of only two survivors of the PIA Flight 8303 crash, his resilience is an inspiration. He doesn’t shy away from sharing his lessons learned, actively participating in conferences and discussions, where his insights on leadership, resilience, and social impact resonate with audiences far and wide.

Zafar Masud is more than just a name, he’s an embodiment of unwavering dedication, entrepreneurial spirit, and a heart for social impact. His story is a testament to the power of resilience and a beacon of hope, reminding us that even in the face of adversity, one can not only build empires but also leave a lasting legacy for the betterment of society.

See also: Mr. Zafar Masud at Cheque Handing Over Ceremony to NOWPDP

ESG Leadership Program is a Game Changer for Banks!

Banks are increasingly recognizing the financial risks associated with climate change, such as more extreme weather events and rising sea levels. By investing in renewable energy and energy efficiency, banks can help mitigate these risks and improve their bottom line.

Environmental factors

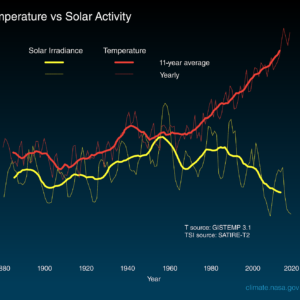

Climate change: Banks are increasingly recognizing the financial risks associated with climate change, such as more extreme weather events and rising sea levels. By investing in renewable energy and energy efficiency, banks can help mitigate these risks and improve their bottom line.

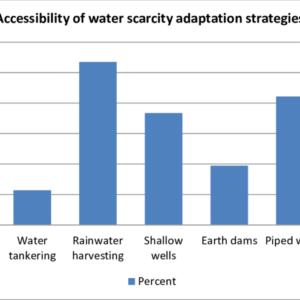

Resource scarcity: Banks are also facing the challenge of resource scarcity, such as water and minerals. By investing in sustainable practices, banks can help conserve resources and reduce their dependence on finite resources.

Social factors

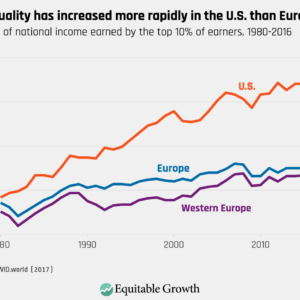

Income inequality: Banks are playing a role in addressing income inequality by providing financial services to underserved communities and promoting financial inclusion.

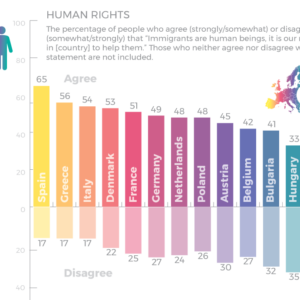

Human rights: Banks are also increasingly concerned with human rights issues, such as labor standards and supply chain transparency. By investing in companies with strong human rights records, banks can help protect workers and communities.

Governance factors

Corporate governance: Banks are also focusing on corporate governance issues, such as board diversity and executive compensation. By investing in companies with good corporate governance practices, banks can help reduce the risk of fraud and corruption.

Transparency: Banks are also becoming more transparent about their own ESG practices. This is in response to growing investor demand for ESG information.

See also: Zafar Masud insights into the Environmental and Social Risk Management Framework

Benefits of ESG for banks

- Reduced risk: By investing in ESG, banks can reduce their exposure to environmental, social, and governance risks. This can lead to lower operating costs and improved profitability.

- Attracting and retaining talent: Employees are increasingly looking to work for companies that are committed to ESG. By investing in ESG, banks can attract and retain top talent.

- Improved brand reputation: Consumers are also increasingly looking to do business with companies that are committed to ESG. By investing in ESG, banks can improve their brand reputation and attract more customers.

- Regulatory compliance: There is a growing body of regulation around ESG. By investing in ESG, banks can ensure that they are complying with all applicable regulations.

Overall, ESG is a game changer for banks because it is a way for banks to address the challenges of the 21st century and create long-term value for their stakeholders.

A Deep Dive into the Pakistan Institute of Corporate Governance (PICG)

In the intricate tapestry of Pakistan’s economic landscape, few threads shine as brightly as the Pakistan Institute of Corporate Governance (PICG). Established in 2002, PICG stands as a stalwart defender of ethical and responsible business practices, a guiding light for corporations navigating the ever-evolving terrain of good governance. With a name that speaks volumes, its mission pulsates with a singular purpose: to elevate the standards of corporate governance across Pakistan, paving the way for a more sustainable and equitable future.

PICG’s vision transcends mere compliance with regulations. It champions excellence in corporate governance, advocating for practices that not only adhere to legal frameworks but also prioritize transparency, accountability, and stakeholder inclusivity. This commitment manifests in a multitude of ways:

- Developing and Disseminating Best Practices: PICG acts as a knowledge hub, meticulously researching and publishing comprehensive guidelines, codes of conduct, and best practices in corporate governance. These resources serve as vital reference points for businesses aspiring to operate with integrity and transparency.

- Capacity Building and Training: Recognizing the need for skilled professionals to champion good governance, PICG offers diverse training programs and workshops. These initiatives equip corporate leaders, board members, and executives with the knowledge and tools to implement best practices and navigate the complexities of responsible business conduct.

- Promoting Stakeholder Engagement: PICG understands that effective corporate governance hinges on robust stakeholder engagement. It actively fosters dialogue between businesses and their shareholders, employees, communities, and the environment, ensuring that decisions take into account the interests of all stakeholders.

- Advocating for Regulatory Reform: PICG plays a crucial role in shaping the legal and regulatory landscape for corporate governance in Pakistan. Through research, advocacy, and collaboration with policymakers, it works tirelessly to refine regulations and promote frameworks that incentivize and enforce responsible business practices.

PICG’s influence extends far beyond individual boardrooms and corporate headquarters. Its efforts contribute to a broader ecosystem of ethical and responsible business practices in Pakistan, unlocking a multitude of benefits:

- Enhanced Investor Confidence: Strong corporate governance practices foster a climate of trust and transparency, attracting both domestic and international investors to Pakistan’s burgeoning economy.

- Sustainable Economic Growth: By encouraging sound decision-making, risk management, and long-term planning, PICG promotes sustainable economic growth, paving the way for a more prosperous future for all.

- Environmental and Social Responsibility: PICG’s emphasis on stakeholder engagement and ethical conduct encourages businesses to prioritize environmental and social considerations, mitigating negative impacts and contributing to a more just and sustainable society.

- Empowering Civil Society: By promoting transparency and accountability, PICG empowers civil society to hold corporations accountable and advocate for responsible business practices in the public interest.

See also: ‘Environmentally sustainable’ bonds

As Pakistan strides towards a future brimming with potential, PICG stands as a beacon, illuminating the path towards sustainable and ethical economic growth. Its unwavering commitment to good corporate governance plays a pivotal role in creating a level playing field for businesses, fostering investor confidence, and propelling Pakistan’s economic engine forward. In the ongoing saga of building a more equitable and prosperous future, PICG’s story – the story of excellence in corporate governance – remains a crucial chapter, one that promises to leave an indelible mark on the landscape of Pakistan’s economic journey.