Zafar Masud’s Interview with Khaleej Times — Navigating Towards A Brighter Future

Khaleej Times interviewed Zafar Masud, President and CEO, at Bank of Punjab. A seasoned banker and entrepreneur with a focus

Khaleej Times interviewed Zafar Masud, President and CEO, at Bank of Punjab. A seasoned banker and entrepreneur with a focus

Zafar Masud Sb. views on Monetary and Fiscal Policy. “Fasten your seatbelts and get ready for a rough ride” —

The Global Economy is transitioning to a new multipolar world order, the most significant shift in the global balance of

The whole idea of Blue Economy is very noble. It is unexplored. Pakistan is still behind coming up the curve

Mr. Zafar Masud and Dr Abid lead the round-table discussion on ‘Pathways to a Sustainable Blue Economy: Role of Financial

Pakistan faces a significant challenge to finance its large trade deficits and external debt repayments. This is reflected in the

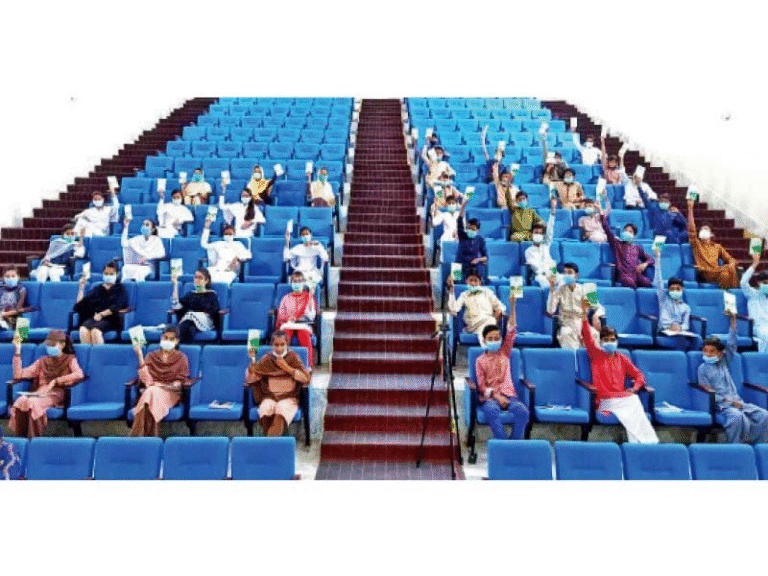

Youth is indicator of how developed a country is, how fast or slow economy grows The following was composed as

There has been a considerable debate on currency management for a while. The pendulum of currency swung between defending currency

Pakistan seems to be suffering from the same syndrome. The obsession and the unwavering trust in multilateral agencies, including IMF,

There has been a considerable debate on currency management for a while. The pendulum of currency swung between defending currency