By Zafar Masud Published in The News and Business Recorder on November 10, 2023

Table of Contents

The Small & Medium Businesses (SMEs) in Pakistan plays a pivotal role in the country’s economy. They are part of essential building blocks of any economy, which significantly contributes towards employment generation through entrepreneurship resulting into greater social good. With a diverse range of businesses such as Manufacturing, Services, and Agriculture, SMEs are the backbone of Pakistan’s entrepreneurial landscape. Small businesses are undoubtedly significant in terms of their ability to strengthen local communities.

Pakistan, the world’s 5th most populated country, has a diverse population of SMEs in the region, estimated at more than 2.8 million formal and informal businesses, predominantly owned and operated by an individual or a family.

- More than 50% of SMEs are engaged in the trading business, with only 22% in the manufacturing sector and 25% in the services sector.

- The SME sector contributes 30% to the country’s GDP, employs more than 80% of the non-agricultural workforce, accounts for 35% of the value-addition in manufacturing industry, and generates 25% of the manufactured exports and FX inflows.

- Fewer than 200,000 SMEs (~6%) currently borrow from banks in Pakistan as per data published by SBP.

Source: Small & Medium Enterprise Development Authority (SMEDA Website)

Issues & Challenges of SMEs Sector

SMEs, ranging from Micro-Enterprises to Small and Medium-sized companies, face challenges like Financial Inclusion, Access to Formal Financing, lack of availability of Financial Advisory Services and Infrastructure related Constraints.

These are summed as below:

Financial Sector

- Scarcity of Financial Solutions and Tailored Products

- Conservative Risk Appetite

- Long Approval Time

- Lack of HR Capacity & Automation

- Lack of Business Model for Small loans

- Stringent Collateral Requirements

SMEs Challenges

- Outdated Machinery

- High Cost of Production

- Low/Insufficient Production Capacity

- Lack of Skilled Labor

- Limited Financial Resources

- Uncertain Economic outlook

- Tax Fears

Informal Lender

- Exorbitant Interest Rates

- Stringent Pay back requirements

- Loan Sharks

Micro-Lender

- High Operating Cost

- Decisions based on minimal financial assessment

- Loans granted usually on reputation of guarantor

Government Interventions

The Government of Pakistan having recognized the importance of this sector, has implemented various policies and initiatives to support SMEs, including the establishment of dedicated financial institution, introduction of capacity-building programs, and ease of doing business reforms. Initiatives such as loan facilities, skill development programs, and technology adoption assistance aim to bolster the SME Sector and foster a robust entrepreneurial ecosystem. Some of these interventions are as below:

- Launch of National Financial Inclusion Strategy – NFIS

- Focus on Diversity & Inclusion especially Women Entrepreneurship

- Approval of The Financial Institutions Act 2016 to facilitate SMEs seeking loans against movable assets as collateral

- Income Tax Reduction for Banks against Profit from incremental lending to SMES from 35% to 20%

- Constitution of National Coordination Committee on SMEs (NCC)

- Approval of National SME Policy

- Allocation of SME Financing Targets to Financial Institutions

- Introduction of Risk Coverage and Refinance Schemes for SMEs

- Promulgation of Single Member Companies Rules 2003

- Launch of Government Subsidized Schemes PMYB&ALS – SAAF

- Revision of SME Prudential Regulations by SBP with enhanced focus on SEs

- Reduction of General Reserve Require ment against Clean loans from 2% to 1%

- Introduction of SME Board at Pakistan Stock Exchange

BOP’s Journey in Supporting the SME Segment

The above interventions made it a business case for BOP to recognize SME segment as a Priority Sector. BOP has heavily invested in developing SME Banking Proposition for both its Asset & Liability Customers. A Sub-Committee of the Board, Strategy, Islamic & Priority Sectors Financing Committee, oversees this segment’s performance on a regular basis. The renewed focus has inter alia enabled the bank to be awarded as “The Best Bank for Small and Medium Businesses” by the Pakistan’s Banks Association in November 2022 followed by the award for “The Best SME Bank” by Asia Money in June 2023.

BOP has undertaken the following initiatives to serve its SME customers in the best possible way and enable them to play their part in the economic development of Pakistan:

- Lending to Youth and Underserved Segments

- Digital Instant Loans – eBusiness Qarza for SMEs

- Focus on Diversity and Inclusion

- Formation of Trade Sales Unit

- Loan Originating System for Credit processing

- Dedicated Collection & Recovery Unit

- Collaboration and MOUs with Entities to promote SME Sector

- Delegation of Approving Authority to Business in order to improve TAT

- Separate Credit Operations Set up

- Diversified Product Suite

- Use of Proxies for assessment

- Digital Receipt of Applications

- Scorecard Model for Decision Making to eliminate Bias

- Collateral Free Lending for Small Businesses

- Customer Awareness / Facilitation Window

- Program Based Lending

- Hub and Spoke Model

- Media and Marketing

BOP’s Strategy is very simple i.e. it aspires to be the Best SME bank in the South Asian Region, where BOP “COMPETE TO WIN…….”

- The Hearts of its customers with E2E Solutions and Service.

- The Market with its Best-in-class Product Suite and Innovation.

BOP has become the leading SME bank in the Pakistan Industry, evident from a 67% growth in SME Advances Portfolio from PKR 30Bn in FY-21 to PKR 50Bn in Q3-23. The bank has further evolved as a Customer Centric Bank; “BOP BUSINESS ASAAN” Segment was introduced for SMEs, clearly reflecting that SME Banking sits at the heart of our strategy.

BOP has consistently been the leading bank in terms of Collateral Free Lending. This has been possible only through adoption of latest tools and technology. We take pride in developing the Digital Loan application Portal. Similarly, our entire SE loan processing is through an in-house developed Loan Originating and Processing system NUCLEUS. This system is based on a set of predefined Feasibilities for the informal sector.

Cash Flow Based Lending Techniques are being used and the model is built based on closed-end Q&A session through recorded lines. It also has the functionality of prediction modelling based on previous evaluations. These are processed at the centralized credit factory at head office. To address the account opening challenges for undocumented SMEs, BOP introduced Simplified Account Opening. To date over 15,000 Accounts have been opened through this facility.

- Over 325,000 SME Customers

- ~Rs 50 Billion SME Loans

- ~2000 Women SME Borrowers

- ~10,000 Commercial Vehicles Financed

- ~10,000 Start Ups Financed

- ~11,000 Collateral Free Loans

- ~25,000 New Jobs Created

Our priority has been to engage Underserved Areas and business places so as to provide SMEs with opportunities for growth. With this view, 20 additional branches were also opened in market areas to cater to the need of growing businesses of SMEs.

Over the years, BOP has built a reputation that is truly valued by its customers. This commitment to excellence has created a strong foundation of trust and loyalty, making the bank a preferred choice for its customers’ financial needs. Such loyalty even outperforms the likes of the oldest players in the market.

BOP has extended Clean Loans to the cottage and home-based industries located in Multan and Bahawalpur zones, especially focused on female SEs. They were not only provided loans for pottery, embroidery, handicraft and other related businesses, BOP also stepped forward to provide them trainings on Financial Literacy.

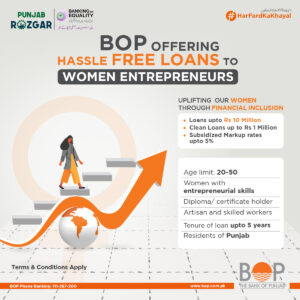

BOP has always been a front liner when it comes to Women Empowerment and played a vital role to empower them through its structured financial services. BOP’s initiative has provided financial independence, catalyzing their journey from individuals to successful entrepreneurs. Needless to mention BOP’s vital role in reducing gender disparity and facilitation through training programs. This shall enable women to achieve financial stability, independence, and a stronger role in their communities.

BOP Naaz Proposition, with concessional markup rates and charges, and higher returns on deposits for female entrepreneurs was launched during the year 2022. Several events and awareness sessions were held under its umbrella. BOP also launched its all-female branch in DHA Lahore to promote this concept.

BOP is the first commercial bank to introduce and implement a Hybrid Automated Statistical Application Scoring Model co-financed by SBP under the SME Challenge Fund. In it’s pursuit of adding extra value to the customer’s experiences, BOP has also introduced a Facilitation Window to aid socio-economic uplift of Startups and SMEs.

Our SME customers can avail the following facilities through this window

- Preparing Business Projections

- Preparing Feasibility reports

- Links for Tax registration & returns, Company formation of start-ups, SME registration

- Guide to all Govt. Schemes

The bank is now geared towards providing a ‘Total Banking Solution’ to the SMEs in the country by offering a complete suite of depository, financing, transactional and non-financial advisory products & services along with a complete package of products and services such as payroll solutions, payments platform, and consumer financing for employees.

Future of SMEs

Banking is very ambitious at BOP, following WIPS (works in progress)

- Collaboration with FinTechs for PAAS, TAAS and SAAS propositions

- Creation of Digital Market Place

- Use of Big Data Analytics for Penetration Modelling and Collection

- Digital Onboarding

- Deep dive into supply chain financing