Transitioning Away from a Cash Economy

As the global economy graduates towards digital payments and digital currency platforms, Pakistan is moving in the opposite direction with

Mr. Zafar Masud regularly contributes to local and international media on topics of banking, economics, energy and management. He is also the author of a publication titled Out of the Box and Out of the Box Volume II“ — a collection of his various newspaper op-eds, and presentations.

As the global economy graduates towards digital payments and digital currency platforms, Pakistan is moving in the opposite direction with

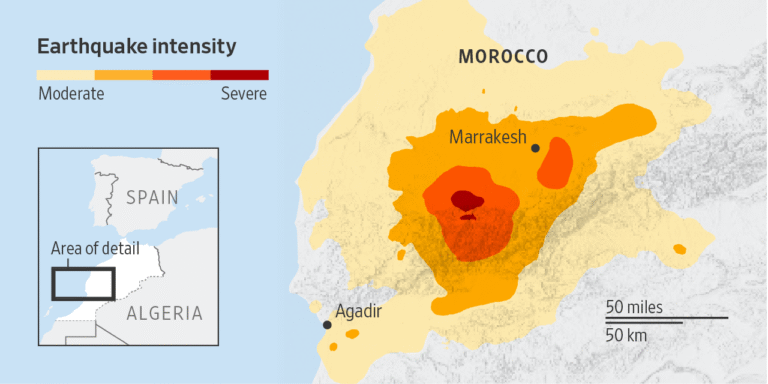

In October, as the world’s attention turns toward Morocco for the Annual Meetings of the World Bank Group and the

If any consensus is to be achieved on any facet of politico-economic landscape, then the starting shall have to be

The World Bank and the IMF have played a pivotal role in shaping the global economic landscape and improving the

The recent developments in the international financial system have ushered in something akin to a Gutenberg moment. In the face

There has been talk lately about the requirement of local currency debt rearrangement for Pakistan, necessitated by the fact that