There maybe further policy rate hike to tackle inflationary pressures.

Here’s my take on the matter which I love to reiterate whenever this subject is broached by skinning the cat in another different way.

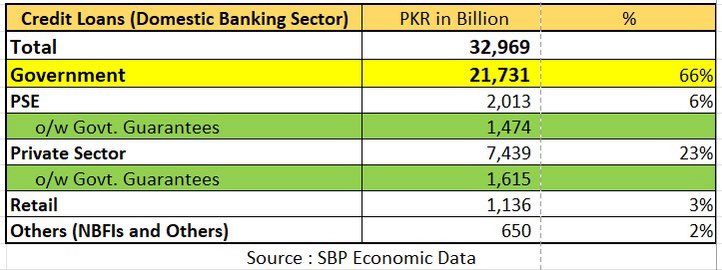

The largest borrower in the market is the government which is the beneficiary of two-third of the total liquidity and with the increase in policy rates, its debt servicing has increased from the budgeted Rs. 4trn to nearly Rs 5.5 trn (10% of GDP).

How will the government service this debt from it’s current total collections of Rs. 8.5trn with FBR tax collection of Rs 7.6trn, out of which the share of the federal government in the divisible pool is only Rs. 3.2trn.

On one hand, the fiscal deficit per se is one of the leading factors driving inflation expectations and on the other, rate hike is pushing the fiscal deficit higher.

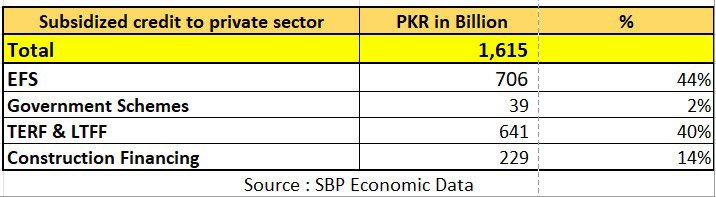

The fact is that the policy rate hike is merely discouraging the credit to the extent of around Rs. 8trn (net of Rs. 1.6trn worth of concessionary financing which remains immune to interest rates movement; in fact, becomes a further burden on fiscal deficit) within which the consumer portion is merely Rs. 1.1trn, or 24% and 3% respectively, of the total lending in the market.

What we need to appreciate in the context of controlling inflation through policy rate phenomenon in Pakistan is that every time we increase policy rate, 82% of the credit portion starts propelling inflation whilst only 18% could possibly be discourage the credit market, and with increasing demand for funding by the government coupled with escalating interest rates, the private sector credit gets squeezed even further.

In other words, tailwind to stoke inflation is 4.56 times more than controlling it when monetary policy tool is employed in isolation without taking necessary actions on fiscal account.