Previous: Is CPI Truly Reflecting the Economic Reality of Pakistan? — IPRI Policy Brief Pt 2

Overview of Inflation Dynamics of Pakistan

The COVID-19 pandemic tremendously impacted the global economy. The disruption in global supply lines with the post-lockdown increase in demand and expansionary fiscal measures resulted in inflationary pressures worldwide. Following the global inflationary trends, Pakistan has also been experiencing inflationary pressures since FY2020, after witnessing mild disinflation between 1970 -2019.

Source: IMF Data Mapper 1

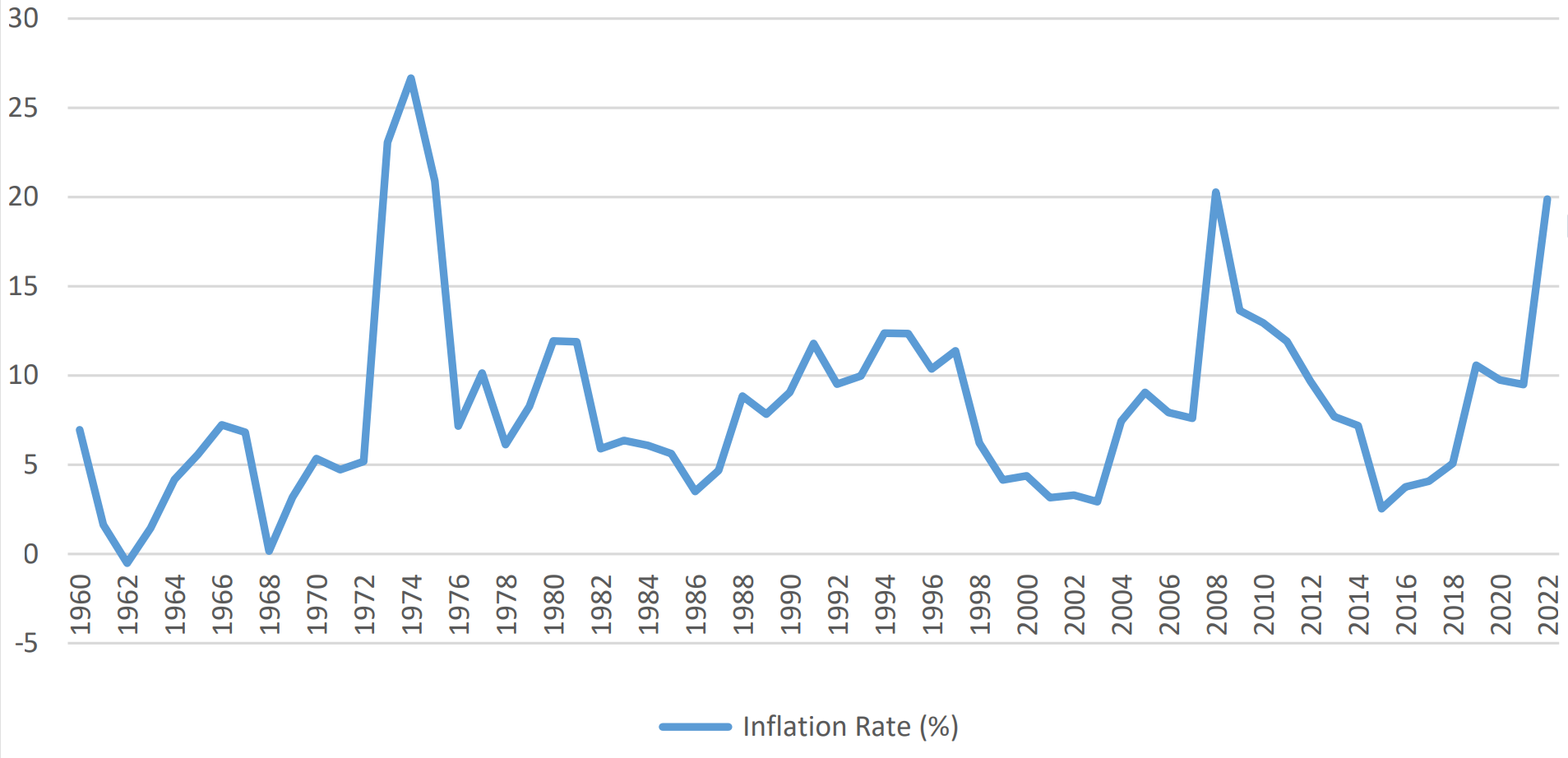

In contrast to the long-term global trends of disinflation, Pakistan did not experience a significant reduction in inflation 2 as shown in Figure 1.

Source: World Bank 3

The above figure shows the rate of inflation from 1960-2022. The country witnessed four periods of high inflation during this time when the inflation rate was higher than the threshold level of 7% for 3 consecutive years including (i) FY73-78 (ii) FY89-98 (iii) FY05- 15 and (iv) FY20- FY24 (H1).

Pakistan’s headline inflation has been relatively higher in all these inflationary episodes including the food and energy inflation. This evidence supports the idea that domestic as well as global demand and supply shocks including high commodity prices specifically oil prices affect Pakistan’s economy.

Moreover, expansionary monetary and fiscal policies, inflation expectations, exchange rate fluctuations, economic and political uncertainty, and natural disasters such as floods and droughts are the key determinants of inflation in Pakistan. 4

Political instability, commodity prices, risks attached to climate change, and global financial conditions result in higher inflation and slower GDP growth. 5

In Pakistan, during 1992-2021 medium and long-term inflation was influenced by increased global commodity prices. However, in the short to medium run, exchange rate fluctuations were the driving force of inflation. Also, government borrowing affected inflation both in the short run and long run. 6

Economic and political instability have a strong impact on the level of inflation in any economy. In Pakistan, the rate of inflation increases with the rise of political instability. These increased rates of inflation directly impact the purchasing power of consumers. 7

However, the major drivers of inflation during the current inflationary period are fiscal policy, especially after high fiscal deficits during FY21 and uncertainty in FY2020 during the COVID-19 pandemic. From FY22 onwards, the country witnessed increased political and economic instability on the account of general elections of 2024. Exchange rate depreciation, inflation expectations, and an increase in global commodity prices also contributed to the current inflationary episode. 8

Source: Pakistan Statistical Bureau, Ministry of Finance

The above figure shows the actual CPI Inflation vs its target and the policy rate for 2000- 2021. Over the last decade, only once actual inflation was equal to its target value i.e. in FY 2006. Otherwise, inflation has either been higher than its targeted value or lower. In Pakistan, only in 2011, the policy rate exactly equal to the actual inflation value, otherwise, the policy rate has been kept higher even in times of low inflation.

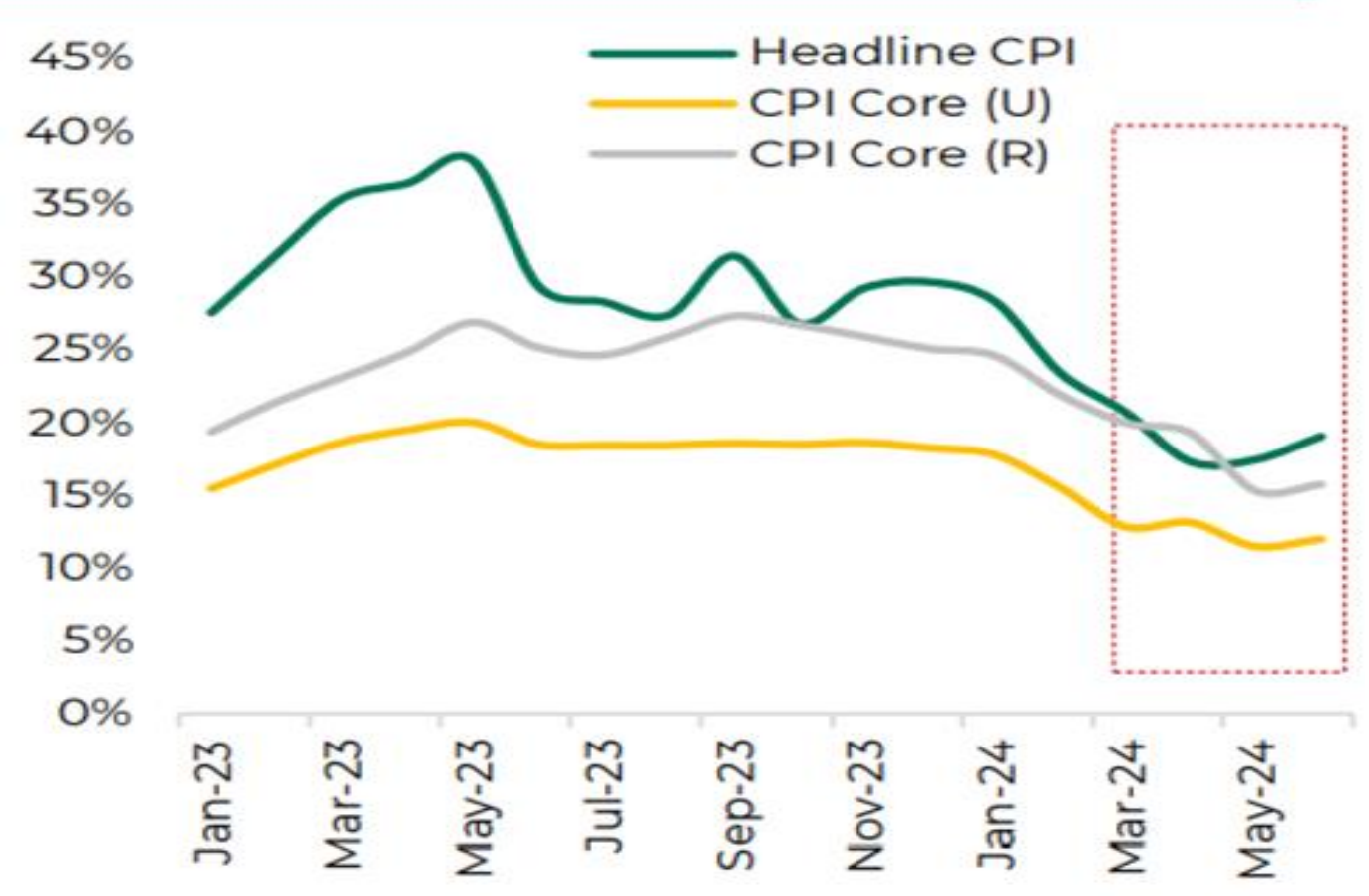

Figure 4: Headline CPI, CPI Core (U) & CPI (R)

Source: KTrade research 9

In 2024, CPI inflation finally started to decline due to the high base year effect with 23.1% in February 2024 compared to 31.5% in February 2023 with core CPI urban and rural both started to ease. Countries including China, India, Sri Lanka, Japan, United Kingdom, and Thailand have been able to tame down post-COVID inflation, unlike Pakistan, Turkey and Argentina. 10

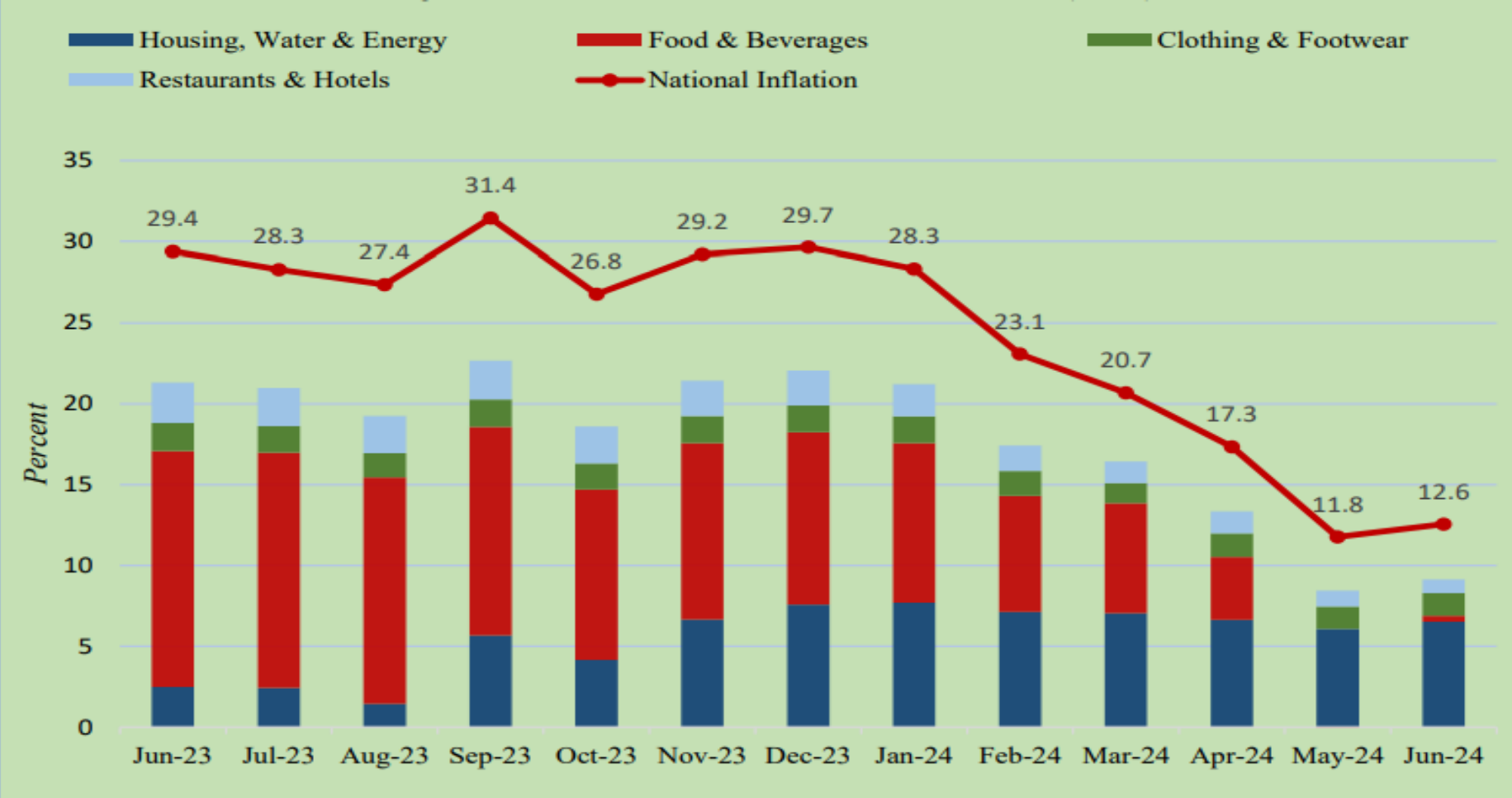

Source: Inflation Monitor 2024, SBP 11

The figure above shows the major contributors to national inflation from June 2023 to June 2024. Given the impact of supply chain disruptions on account of the Russia-Ukraine war, the share of food and beverages was the highest from June 2023. World food prices and exchange rates have a greater impact on domestic food prices. 12

However, on account of increasing fuel prices and hikes in electricity tariffs, the share of the Housing, Water & Energy group has been growing since September 2023.

Up Next: Monetary Policy amid Post-COVID Inflation — IPRI Policy Brief Pt 4

Inflation in Pakistan: Monetary or Fiscal Phenomena

IPRI — Islamabad Policy Research Institute

Policy Brief by

- Zafar Masud

- Dr. Aneel Salman

- Syed Sayam Ali

- Maryam Ayub

August 2024

OGDCL – IPRI Chair Economic Security