Having been meaning to write for a while to share my thoughts on where our core economic problems emanate from. The popular notion that ‘we’re confronted with a ‘trade deficit challenge’ is perhaps correct, but it’s the symptom; not the cause of our problem.

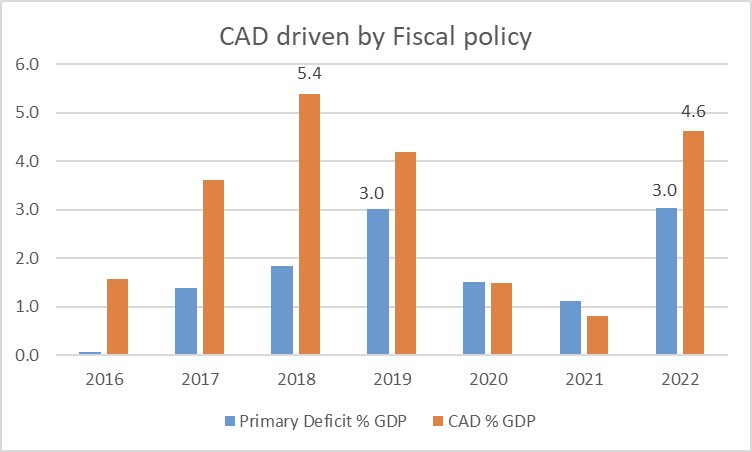

Current Account Deficit (CAD) is our Achilles heel, but it is driven primarily by “Fiscal Policy”, which basically fuels consumption led growth.

This is a sort of good news, as managing fiscal policy is predominantly in our own hands, barring a couple of moot points, like the basis of targeting inflation through monetary policy. But if we get ready to fix the other components of fiscal policy then we get better handle on inflation targeting through monetary policy as well, in due course.

As the solution to all our problems in our formidable years, this is perhaps the time to press the CTRL ALT DEL button, and review our fiscal policy afresh.

We can no longer sustain for the government to continue to run loss-making SOEs and doling out tax exemptions and subsidies to the rent-seeking elites. Resumption of the IMF program will keep us afloat for the short run. How do we escape the boom & bust cycles that have crippled our economy?

2023 WB report highlights that govt. policies (taxes, subsidies, industrial policies, trade restrictions etc) cause distortions that discourage productivity and lead to concentration of wealth; hence, growth is stunted by inability to allocate scarce resources to productive uses

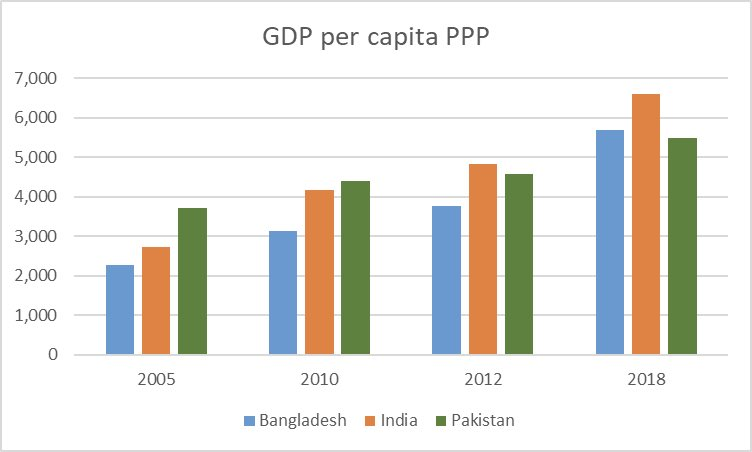

According to the UN data, the average income of the poorest 10% to the average income of the richest 10% is 6.5%, i.e. 16 times the average for the poorest. We compare poorly to Bangladesh (7.5%), India (8.6% ) and Sri Lanka (11%) with rising inequality of income & resources.

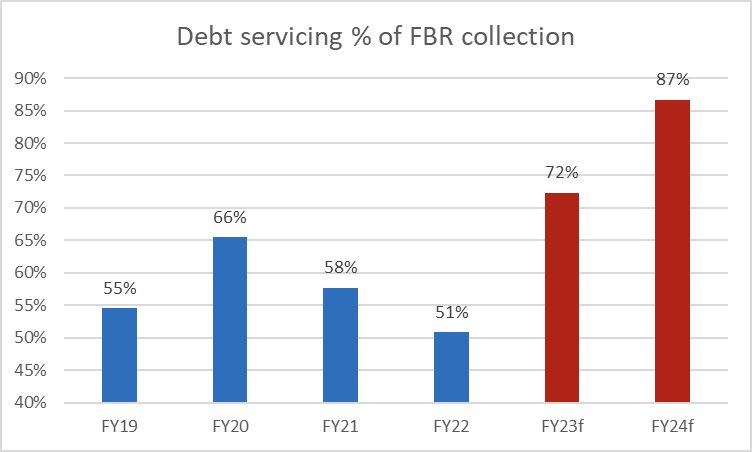

Center of gravity is the unsustainable fiscal policy. Tax collection can no longer service government debt and sustain the government machinery. In the current year, the debt servicing is projected to rise to Rs. 5.5 trillion, which is 72% of the FBR tax collection target.

Solutions are politically difficult to stomach the required reforms. A comprehensive rightsizing of the federal and the provincial governments is needed. Starting point maybe NFC award and 18th Amendment.

WB 2023 report states that Federal government spent Rs. 710bn (1.3% of GDP) on 17 devolved ministries and financing subsidies and development projects that fall under the provincial domain. This overlap of expenditures and responsibilities need to be streamlined.

SOEs losses reportedly have increased to nearly Rs 1 trillion per year, with the power sector the main culprit. No serious effort has been made since 2006 to restructure SOEs and privatize them. However, successful privatization requires strong regulators to foster competition, attract new investment and protect consumers and investors. The starting point to embark upon privatization and an absolute must prerequisites are that the regulators to be strong & independent, and a tailor-made, comprehensive private investor selection framework in-line with each SOE’s, to be put on the block, peculiarities & business needs. This is in the best interest to protect the public value and the economic impact for the very purpose these entities came into being in the first place. With these pre-essentials of privatization in-place, we can immediate offload at least 8 out of top 10 loss making SOEs – DISCOs, Pakistan Steel and Pakistan Post. The others in the bulge like PIA and NHA could be taken care of through an innovative, out of the box structuring, like “viability gap fund, etc.

The only subsidies that the government should implement are direct subsidies to the poorest households and performance subsidies for targeted industries which will generate export/ FX liquidity.

Direct subsidies to the poor and the most vulnerable can be targeted and scaled up using the NSER data of 38mn households.

Performance based subsidies should be time barred and monitored. Unfortunately, subsidies provided today reflect rent seeking by a few powerful lobbies. Instead, scarce resources should target growth sectors including technology, agriculture, and value added export industries.

Pension bill has sky rocketed to Rs 1.5 trillion in FY23, including provincial governments. Unfortunately, govt. is asset rich but cash starved. An innovative solution lies in government asset monetization with transfer of dead assets to the private sector, to generate new income and reduce budget expenditures.

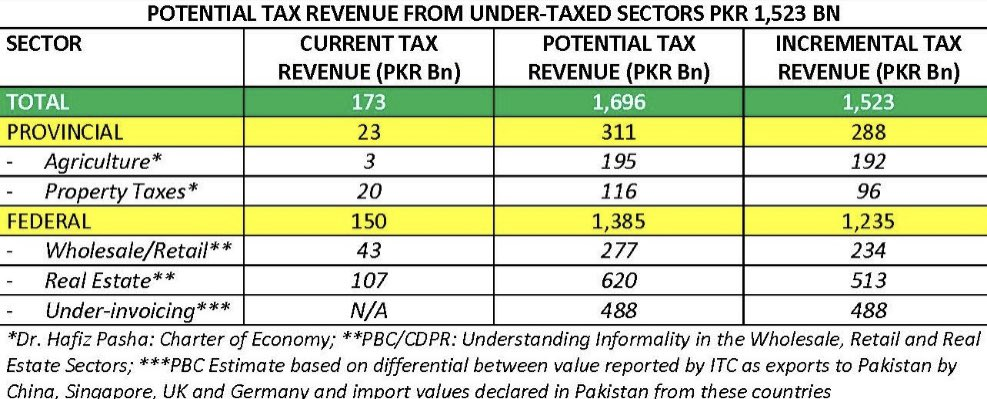

Similarly, on tax policy an estimated Rs 1.8 trillion tax is exempted or ignored from the real estate and retail sectors (PBC Budget proposals). Instead the govt. continues to burden existing tax payers every year, e.g., increase in GST and super taxes.

In my view, we must all start paying their due share of taxes, without any exemptions. Thomas Piketty advocates a progressive tax on wealth to reduce inequality. Norway, imposes a 0.85% tax on net assets. Switzerland imposes wealth tax ranging from 0.1% to 1%.

In Pakistan, wealth tax can be implemented as a Minimum Asset tax, targeting the wealthiest individuals with assets above a defined threshold. Income tax already paid will be adjustable against wealth tax liability. An additional 2 – 3% of GDP in taxes can be collected.

Lastly, agriculture productivity is the solution to our inflation and growth challenges. Food and cotton import bill was recorded at $ 5.5bn in FY2022. Adoption of technology and direct access to credit for farmers can enhance productivity by 40%.