This was originally posted by Zafar Masud on his official X (Twitter) and LinkedIn accounts

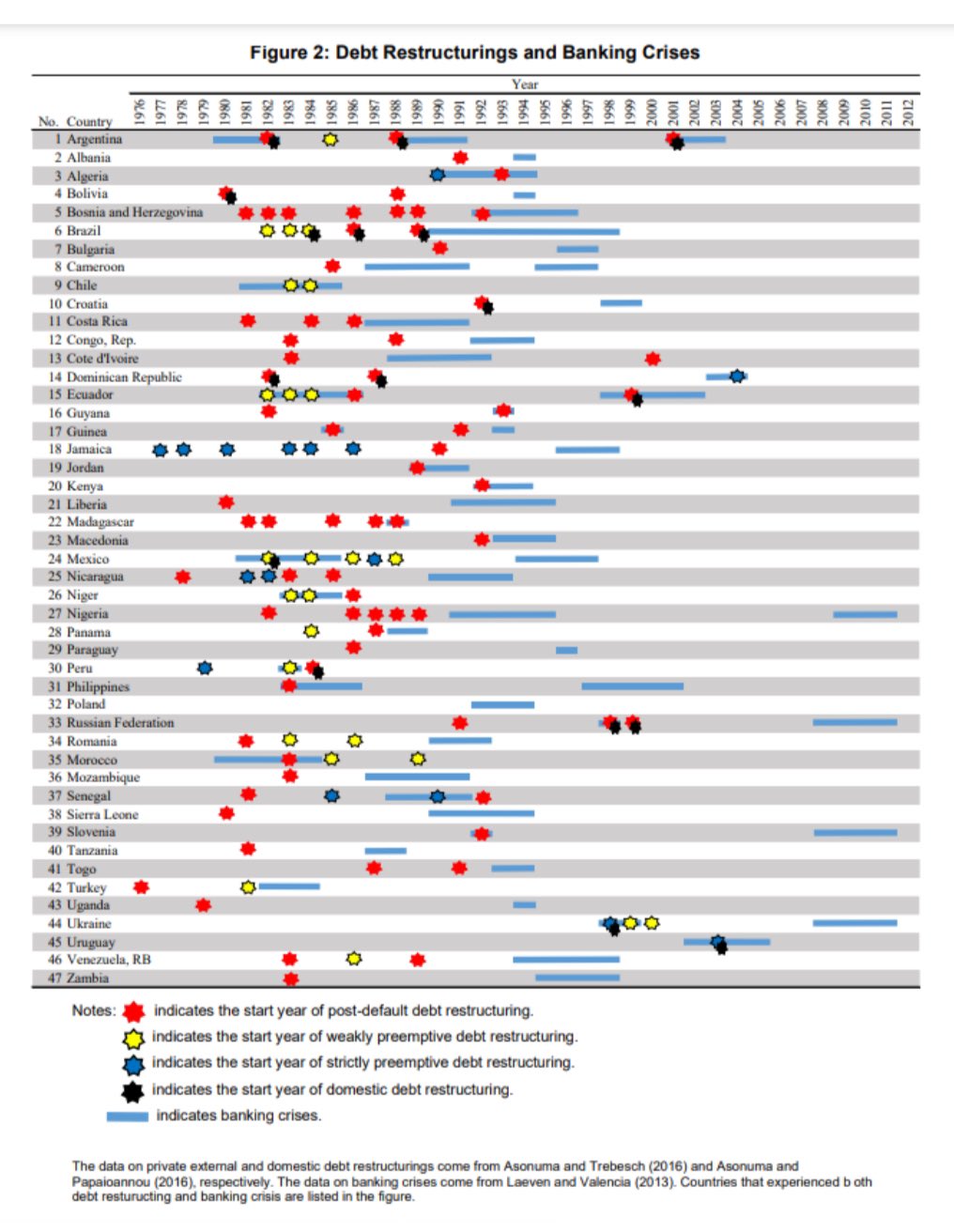

Extremely telling depiction about debt restructuring and uncanny correlation between debt restructuring and banking crises in the attached graph. We need to be extremely careful while suggesting any sort of domestic debt (even) reprofiling; let alone restructuring (entailing any sort of haircut, etc.) all together.

Prerequisites must be kept in mind while talking about any sort of domestic debt reprofiling – 1). foreign debt reprofiling terms & conditions (local currency will be a replica of that also if at all); and 2). more importantly, “aggressive restructuring” of fiscal account (rationalising/ cutting of expenses and enhancing of revenues – both sides of the equation). Otherwise, everything will be shortlived and could lead to very serious banking crises and (since banks are the only source of funding for the government) create even more serious chaos on the fiscal side too.

Further Reading

The article above discusses the difference between default, restructuring, and reprofiling, and how these concepts relate to Pakistan’s current economic situation.

- Default occurs when a borrower fails to meet its contractual obligations to repay debt, either principal or interest.

- Restructuring involves making changes to the terms of a debt agreement, such as reducing the principal amount, extending the repayment period, or adjusting interest rates.

- Reprofiling involves adjusting the payment schedule of a debt agreement without altering the fundamental terms of the debt.

The article argues that Pakistan does not need debt restructuring, but rather reprofiling. This is because Pakistan’s external debts are largely bilateral and multilateral loans, which are typically more flexible to reschedule than bonds. Additionally, Pakistan has a strong track record of repaying its debts, which makes it more likely that lenders will agree to reprofiling.

The article also notes that reprofiling is not a stigma, and that it is becoming increasingly common among emerging markets. In fact, reprofiling can be an opportunity for Pakistan to put its fiscal house in order and address its long-standing economic challenges.

In conclusion, the article argues that Pakistan should focus on reprofiling its external debts in order to avoid default and create a more sustainable debt repayment schedule.