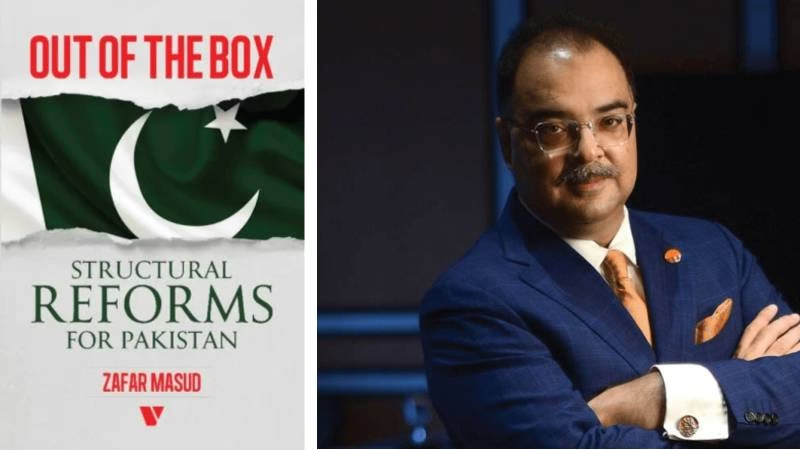

Zafar Masud’s Book “Out of the Box Structural Reforms for Pakistan” reviewed in The Friday Times

Mr. Zafar Masud’s book “Out of the Box Structural Reforms for Pakistan” was published in The Friday Times Review on November 30, 2024.

The review discusses the book’s main thesis, which is that Pakistan’s economic problems are rooted in its fiscal policy. The author Furqan Ali argues that the State Bank of Pakistan’s focus on monetary policy has led to a number of problems, including inflation, debt, and a shrinking economy. He proposes a number of solutions, including disciplining the fiscal side, promoting agricultural exports, and curbing pension liabilities.

Friday Times Review Summary

This is a review of the book “Out of the Box Structural Reforms for Pakistan” by Zafar Masud. The book offers a compelling analysis of Pakistan’s economic challenges while intertwining literature, personal experiences, and innovative policy recommendations for the country’s revival. The author argues that literature is the foundational edifice that hosts all currents of thought, including economic thought.

The book examines how the State Bank of Pakistan (SBP) adopts a radical monetarist stance, often circumventing fiscal policy in favor of parochial decision-making by higher-ups. The author proposes strategies such as bandaging bleeding SOEs, promoting agricultural exports, curbing pension liabilities through asset monetisation, and reducing cash in circulation.

Friday Times Review of ‘Out of the Box: Structural Reforms for Pakistan’ by Furqan Ali

Published in Friday Times on November 30, 2024

Zafar Masud’s “Out of the Box” offers a compelling analysis of Pakistan’s economic challenges while intertwining literature, personal experiences, and innovative policy recommendations for the country’s revival.

It is an archaic polemic in economics—the very existential question of her identity: Is she an artist or a scientist, in the modern sense of the term, embracing empirical, analytical, and mathematical hues? Frankly speaking, as a banal accountant, I am infatuated yet estranged from her, though hoping time unfolds otherwise. Yet, one proposition became vivid after reading veteran banker Zafar Masud’s book ‘Out of the Box: Structural Reforms for Pakistan‘, with a laser-like focus: the artistic undertones that economics possesses, regardless of whether it is inherently artistic or not.

While the book’s main thesis, which I will discuss shortly, is somewhat different, it is the essay ‘Exploring the Link Between Literature and the Economy‘—arguably the crown jewel of the book—that stands out. In this essay, the author elucidates the interplay between economics and literature, highlighting how the latter shapes the former.

See also: Literature and Economy — Role of Commercial Organizations

The author aptly argues that literature is the foundational edifice that hosts all currents of thought, including economic thought; it is the very basis of civilisation itself—the civilisation of Homo sapiens. After all, what is economics but the dealings of people with each other? The essay spans historical ideas from 1500 BC to modern thinkers, contextualising them within the eras in which they emerged. In the author’s words:

“… economic discourse is (and has always been) rooted in the thoughts of great literary authors; their far-reaching contributions still continue to shape current economic decision-making.”

Now, to the main entrée of the book, titled “Fix[ing] the Fiscal Account,” which the author explores extensively. Covering the years 2018 to 2024, the book examines how the State Bank of Pakistan (SBP) adopts a radical monetarist stance, often circumventing fiscal policy in favor of parochial decision-making by higher-ups.

See also: Fix Fiscal Account to Tame Inflation

The premise is straightforward: globally, central banks are designed to operate independently of governments to maintain a healthy economy, primarily by countering inflation through monetary (money-supply) policy. In Pakistan, however, the SBP’s approach to monetary policy—rooted in what the author calls a “theological belief” in the IS-LM model—is flawed because it fails to address the structural issues on the fiscal side.

The government’s overwhelming presence in the credit market further complicates the situation. Consequently, demand for cash remains steady instead of decreasing. This crowds out the private sector, leaving little room for productive investment, stifling economic activity, and simultaneously stunting sustainable growth.

Zafar Masud — Out of the Box: Structural Reforms for Pakistan

For instance, Pakistan faces surreal levels of inflation. To counter it, the SBP raises the policy rate, essentially buying money out of the market to decrease the money supply. In theory, this should suppress inflation. However, the policy has unintended consequences. As the policy rate rises, so do interest payments on government debt. Given the state’s weak revenue mobilisation function, the government finds itself constantly in the torrents of fiscal deficit, which leads to both more borrowing and cataclysmic taxation.

Moreover, the government’s overwhelming presence in the credit market further complicates the situation. Consequently, demand for cash remains steady instead of decreasing. This crowds out the private sector, leaving little room for productive investment, stifling economic activity, and simultaneously stunting sustainable growth.

See also: Fostering Fiscal Sustainability: Insights on Pakistan’s Economic Challenges

To deflate the fiscal deficit, the government resorts to borrowing more or imposing imprudent taxes (usually on already-taxed segments), leading to taxflation and thus reducing consumption, or as Dr Nadeemul Haq puts it, “killing transactions” and thereby “killing economic growth.” The resulting multiplier effect sharply contracts GDP. Simultaneously, a shrinking output lowers exports (due to low investment and low business confidence).

Given the dependence on imports (in a consumption-driven economy), the current account deteriorates, necessitating more loans to maintain foreign exchange reserves, which leads to further rupee devaluation. This devaluation inflates business input costs, which are passed on to consumers, perpetuating the inflationary cycle. Ergo, unless the fiscal account is fixed, the monetary side alone cannot ameliorate the inflation cul-de-sac we are almost always in.

The author also delves into disciplining the fiscal side, proposing strategies such as bandaging bleeding SOEs, promoting agricultural exports, curbing pension liabilities through asset monetisation, and reducing cash in circulation. He advocates for ‘Robin Hood’ taxation — proportionately taxing elites — and restructuring subsidies from the bottom up using tools like the NSER scorecard (as in BISP) rather than top-down approaches. These solutions, while ambitious, reflect a paradigm shift in addressing Pakistan’s long-standing economic woes. For further soliloquy on taming the fiscal account, refer to the book.

Apart from the strictly economical exegesis, the book also contains a monologue from an Islamabad Club talk titled “Borrowed Heaven: Sharing Personal Learnings and Connecting Them with the Country’s Economic Revival.” It is the account of the infamous crash (PK8303) and how this miraculous encounter changed the author’s way of thinking about the economy and life in general. In it, he presents ten learnings, which he is gestating into a book, presenting solutions for economic revival.

See also: Zafar Mausd’s 10 Lessons of Life

In short, Zafar Masud’s Out of the Box offers a compelling analysis of Pakistan’s economic challenges. By dissecting complex issues and proposing practical solutions, the author provides a thoughtful roadmap for the country’s economic revival. However, there is much more to this book than what I have mentioned here. From its exploration of the intersection between literature and economics to its innovative policy recommendations, the book presents a comprehensive vision for Pakistan’s future. This is a must-read for anyone seeking to understand the intricacies of Pakistan’s economic landscape and its potential for transformation.

Add a Comment