Finance Minister Muhammad Aurangzeb visited the Pakistan Banks’ Association and met with the Presidents & CEOs of the banking sector. The Chairman, PBA, Mr. Zafar Masud provided an update on the progress of initiatives aimed at boosting the three key sectors of Agriculture, Small and Medium Enterprises (SMEs), and Digital & Technology in Pakistan.

In his remarks, the Federal Minister called on the entire sector to contribute to priority areas based on their size, capabilities, and unique strengths. He emphasized a return to fundamentals, urging banks to prioritize lending to farmers and increase cash-flow based lending. He expressed confidence in the banking sector’s ability to drive economic growth.

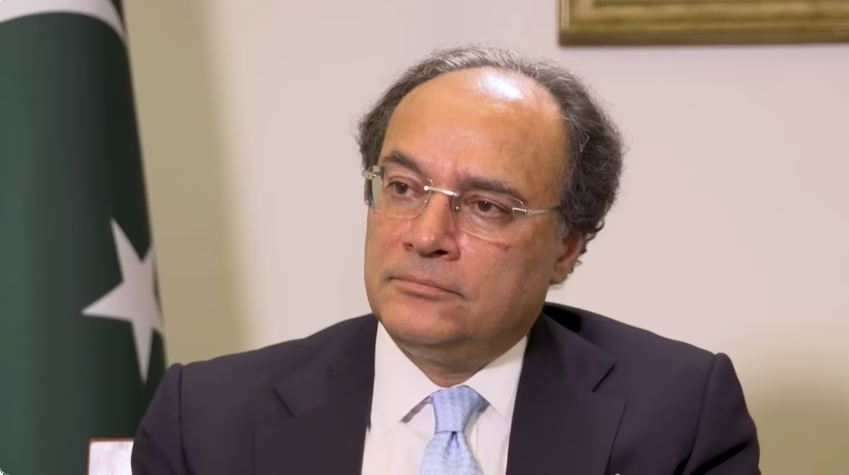

Finance Minister Muhammad Aurangzeb Meets Mr. Zafar Masud updates on the banking sector’s strategic initiatives in priority sectors

KARACHI: Finance Minister Muhammad Aurangzeb (Federal Minister for Finance & Revenue) visited the Pakistan Banks’ Association and met with the Presidents & CEOs of the banking sector. The Chairman, PBA, Mr. Zafar Masud provided an update on the progress of initiatives aimed at boosting the three key sectors of Agriculture, Small and Medium Enterprises (SMEs), and Digital & Technology in Pakistan.

The discussion underlined the banking sector’s commitment to fostering financial inclusion in the Country.

In his remarks, the Finance Minister Muhammad Aurangzeb called on the entire sector to contribute to priority areas based on their size, capabilities, and unique strengths. He emphasized a return to fundamentals, urging banks to prioritize lending to farmers and increase cash-flow based lending. Finance Minister Muhammad Aurangzeb also expressed confidence in the banking sector’s ability to drive economic growth.

Regarding the digital sector, the Finance Minister Muhammad Aurangzeb advocated for supporting software houses and freelancers. Highlighting IT as a key growth driver, he stressed the importance of leveraging the substantial IT budget. The Minister encouraged banks to collaborate with the government to maximize the impact on the IT sector.

During the session, Chairman PBA, Zafar Masud, along with the Steering Committee members on these initiatives, including Senior Vice Chairman PBA, Yousaf Hussain, Vice Chairman PBA, Ahmed Bozai, and CEO/Secretary General PBA, Muneer Kamal, gave a comprehensive presentation on the developments in each sector. The proposals were developed in close consultation with SBP to ensure they effectively address the unique challenges and highlight the opportunities within each sector.

Finance Minister Muhammad Aurangzeb commended PBA’s Steering Committee, and the respective Task Forces for their thorough analysis and valuable recommendations. He highlighted the crucial role of the banking community in driving economic growth. He stressed that the banks to enhance their efforts in supporting these priority sectors to foster economic development and prosperity.

“The PBA is taking decisive steps to work with the Ministry of Finance and the SBP in implementing these recommendations to enhance the banking sector’s contribution to Pakistan’s economy.”

Zafar Masud, Chairman – PBA at the end of the meeting.

The meeting was attended by Minister of State, Ali Pervaiz Malik, Chairman Federal Board of Revenue (FBR) Amjed Zubair Tiwana, Director to Minister Finance Sheharyar Ahmad, and CEOs of leading banks. Other senior officials from the PBA were also present at the meeting.

Pakistan’s Banking Sector: A Strategic Shift towards Priority Sectors

Pakistan’s banking sector has been undergoing a significant transformation, with a renewed focus on supporting key economic drivers. In a recent announcement, the Finance Minister Muhammad Aurangzeb outlined a series of strategic initiatives aimed at boosting lending to priority sectors such as agriculture, Small and Medium Enterprises (SMEs), and digital technology.

Agriculture: The Finance Minister Muhammad Aurangzeb’s call for increased lending to farmers underscores the critical role of agriculture in Pakistan’s economy. By providing adequate financial resources, banks can help farmers invest in modern agricultural techniques, improve yields, and enhance food security. Moreover, the emphasis on cash-flow-based lending is a welcome development, as it can provide farmers with the flexibility they need to manage their finances effectively. This approach aligns with the government’s broader efforts to promote sustainable agriculture and reduce poverty in rural areas.

Read more: Innovation for Pakistan’s Agriculture

SMEs: The banking sector’s commitment to supporting SMEs is equally significant. SMEs are the backbone of many economies, and their growth can create jobs and drive economic development. By providing SMEs with access to affordable financing, banks can help them expand their operations, innovate, and contribute to Pakistan’s economic prosperity. This is particularly important for Pakistan, as SMEs constitute a significant portion of the country’s economy and employ a large number of people.

Read more: Transforming the Lives of SMEs

Digital Technology: The focus on digital technology is another strategic move that aligns with the global trend towards digitalization. By supporting software houses and freelancers, the banking sector can help Pakistan develop a thriving digital economy. This, in turn, can attract foreign investment, create high-quality jobs, and improve the country’s competitiveness on the global stage. Furthermore, the digital economy can play a crucial role in promoting financial inclusion and reducing the digital divide.

Read more: Mr. Zafar Masud on the integration of digital technology with banks

Collaboration and Implementation: The Pakistan Banks Association (PBA) is working closely with the Ministry of Finance and the State Bank of Pakistan to implement these strategic initiatives. This collaboration is essential for ensuring that the banking sector can effectively meet the needs of priority sectors and contribute to Pakistan’s economic growth. The PBA’s involvement in this process demonstrates its commitment to supporting the government’s economic agenda and promoting the development of a vibrant and inclusive banking sector.

Challenges and Opportunities: In addition to these strategic initiatives, the banking sector is also facing a number of challenges, including rising non-performing loans, competition from non-bank financial institutions, and the increasing complexity of regulatory requirements. To address these challenges, banks will need to adopt innovative business models, invest in technology, and strengthen their risk management capabilities.

The Road Ahead: The shift towards priority sectors represents a significant opportunity for Pakistan’s banking sector to play a more active role in driving economic growth and development. By providing adequate financing to farmers, SMEs, and the digital technology sector, banks can help to create jobs, reduce poverty, and improve the country’s competitiveness on the global stage. However, to fully realize the benefits of this strategic shift, the banking sector will need to address the challenges it faces and continue to adapt to the changing economic landscape.

Beyond the Immediate: While the focus on priority sectors is a crucial step in the right direction, it is important to recognize that the banking sector’s role in Pakistan’s economic development extends beyond these areas. Banks can also contribute to financial inclusion, poverty alleviation, and social development by providing access to financial services to underserved populations and supporting sustainable development initiatives.

Conclusion: The banking sector’s strategic shift towards priority sectors is a positive development that has the potential to drive economic growth and improve the lives of millions of Pakistanis. By providing adequate financing to farmers, SMEs, and the digital technology sector, banks can play a crucial role in supporting the country’s economic development and building a more prosperous future. However, to fully realize the benefits of this strategic shift, the banking sector will need to address the challenges it faces, continue to adapt to the changing economic landscape, and expand its role in promoting financial inclusion and sustainable development.

Finance Minister Muhammad Aurangzeb – A Brief Profile

Federal Minister for Finance & Revenue – Government of Pakistan

Finance Minister Muhammad Aurangzeb has been serving as the Federal Minister for Finance and Revenue in the Government of Pakistan since March 2024. His appointment comes at a crucial time for the country as it navigates economic challenges and seeks to implement effective financial policies.

Professional Background

With an impressive career spanning over 35 years in the international banking sector, Finance Minister Muhammad Aurangzeb has garnered extensive experience that greatly benefits his role as Finance Minister. His most recent position was as the President & CEO of Habib Bank Limited (HBL), Pakistan’s largest systemically important bank, where he played a pivotal role in the bank’s growth and transformation.

Key Positions Held

- CEO of JP Morgan’s Global Corporate Bank (Asia Pacific): Prior to returning to Pakistan, he led JP Morgan’s operations in one of the most dynamic regions for corporate banking.

- Senior Management Roles: Finance Minister Muhammad Aurangzeb has held influential positions at prestigious global financial institutions, including:

- ABN AMRO

- Royal Bank of Scotland (RBS)

- Citibank

These roles took him across major financial hubs, including New York, Amsterdam, and Singapore.

Notable Achievements

- Global CEO Council Membership: In 2018, Finance Minister Muhammad Aurangzeb was the only Pakistani invited to join the Global CEO Council, organized by the Wall Street Journal/Dow Jones Group. This exclusive membership underscores his standing in the global financial community.

- Leadership Roles in Banking Associations:

- Chairman of the Pakistan Banks Association

- Chairman of the Pakistan Business Council

- Council Member at the Institute of Bankers Pakistan

These positions reflect his commitment to advancing the banking sector and fostering business growth in Pakistan.

Education

Finance Minister Muhammad Aurangzeb’s academic credentials are equally impressive. He holds a Bachelor of Science (BS) and a Master of Business Administration (MBA) from The Wharton School, University of Pennsylvania. This prestigious education has equipped him with the analytical skills and strategic vision necessary for effective leadership in finance.

Conclusion

As Finance Minister Muhammad Aurangzeb brings a wealth of experience and a global perspective to Pakistan’s financial landscape. His extensive background in international banking, coupled with his leadership in various financial institutions, positions him as a key figure in shaping the country’s economic policies and driving sustainable growth. The coming years will be crucial as he leverages his expertise to address the challenges facing Pakistan’s economy.